2nd Quarter 2021 Newsletter from Fort Pitt Capital Group

As Good as it Gets

Market Update

Equities posted another quarter of strong returns with the S&P 500 Index advancing by 8.6% and recording its fifth straight quarterly gain. Bullish sentiment was driven by the central bank liquidity tailwind, fiscal stimulus, continued vaccine progress, reopening momentum, and a strong corporate profit backdrop. While equity markets experienced some brief bouts of volatility attributable to inflation concerns and more hawkish commentary from the Federal Reserve, declines were shallow and short-lived as the “buy-the-dip” mantra remained intact.

After lagging in the first quarter, growth stocks handily outpaced value and cyclical stocks in the second quarter. While the forward-looking prospects for growth versus value can be debated, the recent rotation into growth stocks reflects investor expectations that we have reached the peak in terms of the velocity of economic growth, inflation, and monetary policy.

The peak growth narrative was also evident in fixed income market performance. Despite the heightened focus on elevated inflation readings, intermediate and long-maturity bond yields declined in the second quarter. This outcome translated into positive returns from the bond market with most segments of the fixed income market recovering a substantial portion of the first quarter declines.

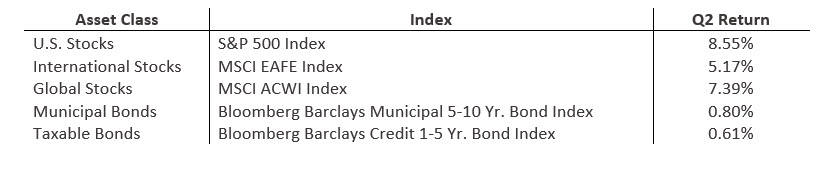

Below is a summary of second quarter performance results for several major indices:

Economic Update

The economic recovery picked up steam in the second quarter as pent-up demand and excess savings amplified the reopening momentum already stemming from vaccine traction. Consumer spending has now surpassed pre-pandemic levels and the unemployment rate continued to decline as 1.7 million workers returned to the payrolls in the quarter. The economic acceleration has resulted in upward revisions to growth estimates with the Federal Reserve recently increasing their forecast for 2021 GDP growth to 7%. And on the corporate earnings front, analysts are expecting almost 64% earnings growth compared to the second quarter of 2020. This outcome would represent the highest year-over-year earnings growth rate since the fourth quarter of 2009.

While the surge in economic activity is encouraging, it also resulted in the highest inflation readings in 30 years. There is no doubt that the economy is currently experiencing upward price pressures stemming from supply chain disruptions, higher raw materials costs, and a tightening labor market. The unresolved question remains – are these inflationary pressures transitory or longer lasting. Judging by the recent drop in bond yields, rollover in many commodity prices, and the decline in longer-term inflation expectations, investors are currently taking the view that these pressures and imbalances will be resolved over time. We expect this debate will continue for some time and will be watching developments closely.

Closing Thoughts

The second quarter may mark the peak in terms of GDP and corporate earnings growth rates as well as the crest of monetary support from central banks. It is unreasonable to expect the U.S. or any other developed economy to grow at 6%-7% for a sustainable period and corporations will not be able to maintain such a blistering pace of earnings growth. And while equity markets may need time to adjust to the eventual withdrawal of monetary stimulus, we expect the pullback in support to be a slow and measured process over a considerable period of time. So, while this may be as good as it gets in terms of growth velocity, we still expect above-trend growth for the foreseeable future as the economy continues to heal from the massive plunge in the spring of last year.