Attract and retain employees with a better retirement plan.

Every business owner wants to be successful. Wise business owners know they can’t do it alone. It takes a team of people supporting you along the way.

Happy, financially secure employees are key to creating successful organizations. But many employers don’t have the time to become an expert on the ins and outs of available retirement plan options.

At Fort Pitt Capital, we work with our clients to create a comprehensive retirement plan that brings you maximum protection and peace of mind for your employees.

Companies or financial advisors that help individuals and businesses create and manage retirement savings plans. Here’s a breakdown of what they do:

Types of Retirement Plans They Help With

- Employer-sponsored plans:

- 401(k) and 403(b): The most common types, where employees contribute pre-tax income, and employers may offer matching contributions.

- Traditional and Roth IRAs: Individual Retirement Accounts where you save money for retirement on your own.

- Defined benefit plans (pensions): Less common now, these offer guaranteed payouts in retirement based on factors like salary and years of service.

- Individual plans:

- Traditional and Roth IRAs: Individuals set these up themselves to save and invest.

- SEP IRAs and Solo 401(k)s: Designed for small business owners and the self-employed.

Plan Design: Help employers choose the right business plan type and customize it based on goals and demographics.

Administration and Recordkeeping

- Manage enrollment and contributions

- Track investment balances

- Process withdrawals and loans

- Prepare tax reporting and handle regulatory compliance

Investment Selection and Advice

- Create a menu of investment options

- Offer guidance to employees about choosing investments that align with their risk tolerance and goals

- Optional professionally managed portfolios

Education and Communication:

- Provide information about retirement planning to employees

- Offer enrollment assistance, investment workshops, and online tools to help employees understand their plans.

Why Companies and Individuals Use Retirement Plan Services

- Specialization: These companies have specialized knowledge of retirement plans, investment strategies, and complex regulations.

- Reduce Administrative Burden: Outsourcing plan management frees up time for businesses to focus on their core operations.

- Fiduciary Responsibility: Some retirement plan service companies act as fiduciaries, meaning they’re legally obligated to act in the best interests of plan participants.

Choosing a Retirement Plan Service Provider

Consider the following when selecting a provider:

- Fees: Understand fee structures and compare them across different providers

- Services Offered: Ensure the services provided meet your specific needs.

- Investment Options: Review the quality and range of investment choices.

- Reputation and Experience: Look for a well-established company with a good track record.

SEP IRA: Easy to set up and inexpensive. Contributions are made only by the employer. Well-suited for businesses with fluctuating income and/or few employees.

SIMPLE IRA: Also low-cost and less administrative hassle. Employees and employers contribute. Ideal for businesses with 100 or fewer employees.

401(k) Plans: The most popular choice. Offers various investment options and sometimes includes employer matching contributions. There are a few versions, including:

Traditional 401(k): Pre-tax contributions, reducing current taxable income. Taxes are paid when funds are withdrawn in retirement.

Safe Harbor 401(k): Simplifies administration; the employer is required to make contributions.

Roth 401(k): Contributions made with after-tax dollars, but withdrawals in retirement are often tax-free.

Solo 401(k): Great for self-employed individuals and business owners with no employees (other than a spouse).

Other Plans to Consider

Profit-Sharing Plan: Employer contributions fluctuate based on company profits. Offers flexibility and tax benefits for the business.

Defined Benefit Plan (Traditional Pension): Promises a specific monthly payout in retirement. These plans are complex to administer and typically better suited to larger, well-established businesses.

Factors to Consider When Choosing

Size of your business: Some plans are geared more towards small businesses or the self-employed.

Company budget: Costs to set up and maintain plans vary. Consider employer matching contributions if offered.

Desired involvement level: Administrative complexity differs between plan types.

Employee needs: Consider tax advantages and investment options for both employer and employees.

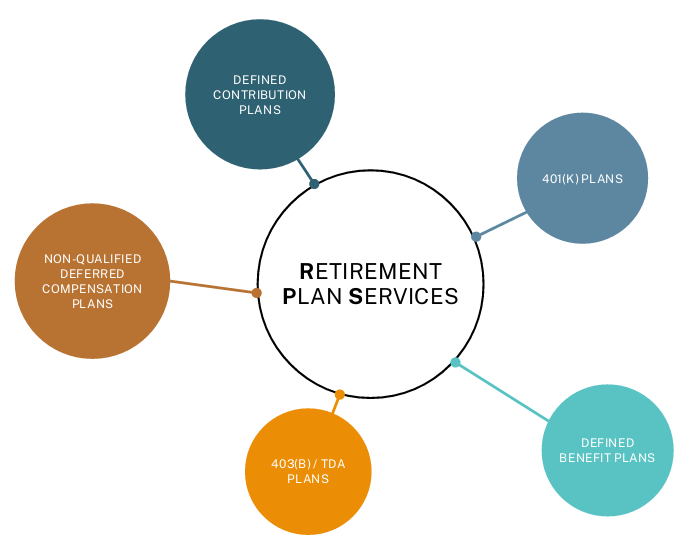

1) Defined Benefit vs. Defined Contribution Plans:

- Defined Benefit Plans: These plans guarantee a specific retirement benefit, typically a monthly payment, based on a formula that considers your salary and years of service. The employer carries the investment risk, meaning they are responsible for ensuring that there’s enough money to pay out the promised benefits. Examples of these plans are becoming less common, but some government jobs and union contracts may still offer them.

- Defined Contribution Plans: In these plans, you and/or your employer contribute money to your individual account. The amount you receive at retirement depends on the amount contributed, investment growth (or loss), and any fees. You carry the investment risk but have more control over your investment choices. 401(k), 403(b), and TDA plans are all types of defined contribution plans.

2) 401(k) vs 403(b) / TDA Plans:

- 401(k): These are employer-sponsored retirement plans offered by for-profit companies. Employees can choose to contribute a portion of their salary before taxes, reducing their taxable income. Many employers offer matching contributions, essentially free money that boosts your retirement savings. Contributions and earnings grow tax-deferred until withdrawal in retirement, which will be taxed as income.

- 403(b) / TDA Plans: Similar to 401(k)s, these plans are for employees of public schools, certain non-profit organizations, and tax-exempt hospitals. They are also tax-advantaged, with pre-tax contributions reducing taxable income and earnings growing tax-deferred. However, they may have different investment options and contribution limits than 401(k)s. TDA, or Tax-Sheltered Annuity, is an older term sometimes used for 403(b) plans.

3) Non-Qualified Deferred Compensation Plans:

These plans differ from the others because they don’t offer tax advantages on contributions. Instead, you elect to defer a portion of your salary until a later date, like retirement. The benefit is that you delay paying taxes on that income. However, there are some drawbacks:

- Riskier: The money isn’t held in a separate account and is considered an asset of the employer. If the company goes bankrupt, you may not receive the full amount deferred.

- Less Flexible: Access to the funds is usually restricted until retirement, death, disability, or a similar qualifying event.

- Tax Implications: You’ll pay income tax on the deferred amount when you eventually receive it, and there may be additional penalties depending on the withdrawal reason.

Choosing the Right Plan:

The best plan for you depends on your employer’s offerings and your individual circumstances. Consider factors like contribution limits, investment options, employer matching, and your risk tolerance. Talking to a financial advisor can help you make an informed decision.

Retirement Plan Administration and Compliance Services are specialized services that help employers manage and maintain their company-sponsored retirement plans. Here’s a breakdown of what they are and why they’re important:

What are Retirement Plan Administration and Compliance Services?

Plan Administration:

- Collecting employee data: Gathering information like age, salary, hire date, etc.

- Eligibility and enrollment: Determining when employees are eligible to join the plan and facilitating their enrollment.

- Contribution calculations: Calculating how much employees and employers can contribute, especially in plans with matching or profit-sharing components.

- Investment tracking: Monitoring investment performance and ensuring everything aligns with plan rules and participant choices.

- Vesting calculations: Determining how much of an employer’s contributions become the employee’s permanent ownership over time.

- Distributions and loans: Processing withdrawal requests and retirement plan loans in accordance with regulations

- Recordkeeping: Maintaining accurate and up-to-date records of all plan activity.

Compliance Services:

- Plan document maintenance: Ensuring the plan document, which outlines the rules and operation of the plan, stays up-to-date with the latest regulations.

- Regulatory testing: Performing complex tests (like non-discrimination testing) to ensure the plan doesn’t unfairly favor highly compensated employees.

- Government reporting: Preparing and filing required annual reports with agencies like the IRS and the Department of Labor (e.g., Form 5500).

- Plan corrections: Identifying and fixing any operational errors in the plan to avoid penalties.

- Audits: Assisting with IRS or Department of Labor audits by providing documentation and explanations.

Why Companies Use These Services:

- Complexity of Regulations: Retirement plan laws and regulations are constantly changing and can be extremely complex to navigate. These services provide guidance to ensure plans operate correctly.

- Risk Mitigation: Mistakes in retirement plans can lead to costly penalties, fines, or even plan disqualification. Administration and compliance services help minimize these risks.

- Time Savings: Managing a retirement plan in-house is incredibly time-consuming. Outsourcing these tasks frees up your HR staff to focus on other strategic initiatives.

- Fiduciary Responsibility: Employers have a fiduciary responsibility to act in the best interest of plan participants. Specialized third-party administrators provide an extra layer of protection and expertise.

Who Provides Retirement Plan Administration and Compliance Services?

- Third-Party Administrators (TPAs): Independent firms specializing in all aspects of retirement plan administration and compliance.

- Financial Institutions: Banks, investment firms, and insurance companies often offer these services along with their investment products.

- Recordkeepers: Companies that handle the day-to-day transactional recordkeeping elements of a retirement plan may also offer some administration and compliance support.

Let's Talk About Our Retirement Plan Sponsor Services

We craft a direct employee education strategy and provide both group and one-on-one sessions to enhance participants’ understanding of their retirement plan and save for retirement.

Let us help your employees accumulate, invest, and manage their retirement assets. Retirement plans are complex and ever-evolving. Stop wasting time trying to become an expert and let the team at Fort Pitt Capital help you strengthen your business.

Contact Us Today