Quarterly Newsletter: Turning the Page to 2022

Equity markets closed out 2021 on a high note with the S&P 500 Index advancing by 11% and logging its best quarter of the year. Investors continued to show a willingness to look past ongoing supply chain disruptions, consumer price inflation near 40-year highs, and expectations for removing accommodative monetary policy. And while news of the Omicron variant resulted in market volatility late in the quarter, investors took solace in data indicating much less severe symptoms as well as guidance from U.S. policymakers that they would opt for mitigation measures instead of disruptive restrictions or draconian lockdowns.

The positive narrative can be attributed to the usual suspects – above-trend economic growth, improving labor market, robust consumer spending, and corporate earnings results that continue to outpace expectations.

The intermediate-maturity Bloomberg U.S. Aggregate Bond Index was unchanged in the final quarter of 2021. However, interest rates for short and long-maturity bonds moved in different directions resulting in a “flattening” of the Treasury yield curve. Short-term Treasury yields rose precipitously given growing anticipation of the Federal Reserve beginning to hike interest rates at some point in 2022. Longer-term Treasury (20-year and 30-year) bond yields declined, showing little concern about elevated inflation readings.

At the end of the year, 10-year Treasury bonds offered investors a yield of 1.51%. The most recent CPI – Consumer Price Index report showed headline inflation levels of 6.8%, leaving “real” or inflation adjusted yields deeply in negative territory. Historically, real interest rates this far into negative territory have been associated with depressionary or wartime periods, not with equity markets hovering around all-time highs, surging home prices, and nearly full employment. While it is difficult to forecast how this relationship will conclude, we anticipate inflation and interest rates to be major determining factors to asset class performance outcomes in 2022.

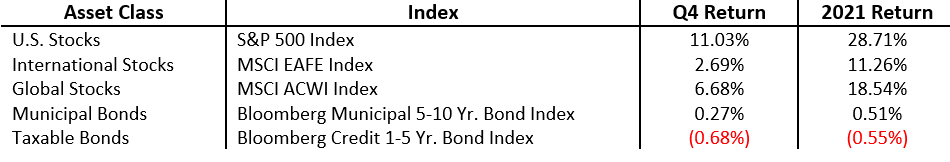

Below is a summary of fourth quarter and full-year 2021 performance results for several major indices:

We look forward to our upcoming webcast and client appreciation events, where we will provide a detailed overview of our outlook for 2022. Here are some abbreviated thoughts in the meantime.

We will start with the conclusion. We foresee a continuation of above-trend economic growth in 2022 as the economy continues to normalize. GDP growth will certainly downshift from the unsustainable pace registered in 2021 but remain well above historical averages. Corporate earnings growth should also serve as a supportive tailwind with current estimates projecting +9% earnings growth for S&P 500 companies in 2022. Consumers enter the year well positioned with healthy balance sheets and high levels of excess savings. Corporations are also flush with cash after massive capital raises in 2020 and strong earnings/cash flows in 2021. This bodes well for increased shareholder returns in the form of dividend hikes and share buyback programs as well as for capital spending. We expect these positives to be enough to generate another positive year for equity markets in 2022.

We anticipate several challenges and headwinds with more volatility and deeper market pullbacks than the almost uninterrupted uptrend in 2021.

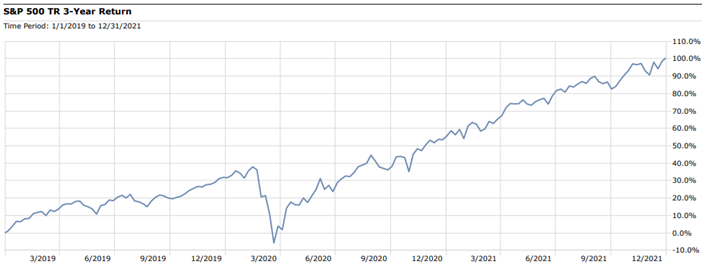

Source: Morningstar Direct

Equity investors have enjoyed three consecutive years of extremely strong market returns. To put that into context, the S&P 500 has produced a cumulative return of 100%, or an annualized return of 26% over this period.

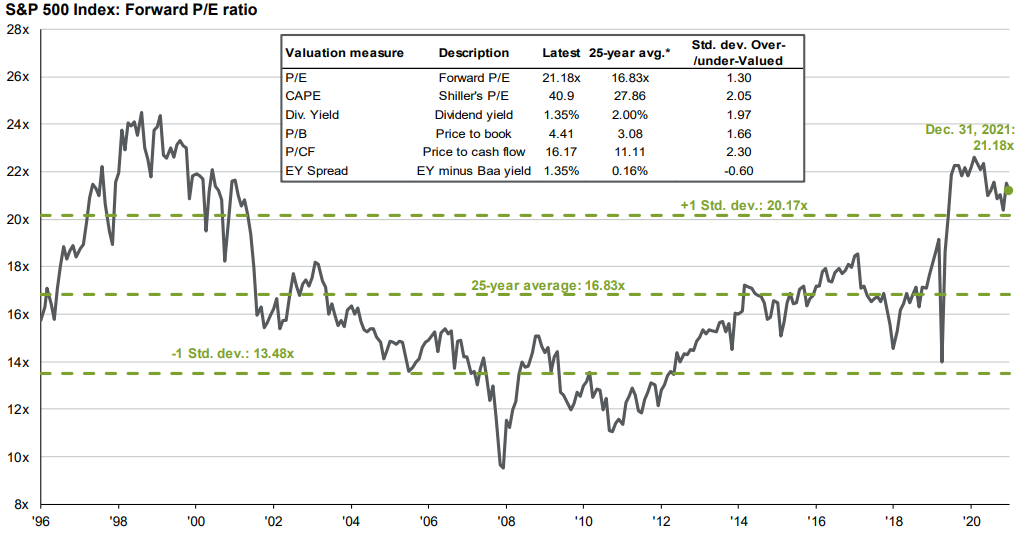

But this phenomenal run has also resulted in elevated valuations for broad market indices and a more challenging “starting point” for the year.

Source: Guide to the Markets – U.S. Data are as of December 31, 2021.

Financial markets may need time to adjust from a period of unprecedented monetary and fiscal policy support to a much different environment of tightening financial conditions. The Federal Reserve increased the size of its balance sheet by more than $4.5 trillion since the onset of the pandemic. The cumulative fiscal response adds up to 25% of annual U.S. GDP compared to a 10% decline in the economy at the height of the pandemic. While the goal of reflating the economy (and markets) has been achieved, those supportive tailwinds are likely to dissipate, with the Fed signaling multiple interest rate hikes for 2022 and forecasts for significantly lower budget deficits next year. We expect tighter monetary and fiscal policy to put a cap on equity market returns for 2022.

Inflation concerns will undoubtedly carry into the new year as well. As we discussed last quarter, our baseline expectation is for inflationary pressures to recede as the year progresses, supply chains unclog, and demand is more evenly allocated between goods and services. However, rising rents and wages costs appear to be stickier and longer-lasting components of the inflation equation given substantial increases in home prices and difficulty finding workers. Risks remain that price pressures don’t subside as anticipated and inflation expectations become more entrenched among consumers and corporations. We expect multiple twists and turns in the inflation narrative throughout the year.

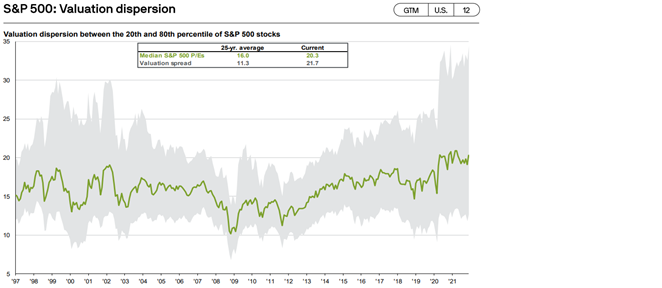

In summary, we think the combination of strong economic and corporate earnings growth will be sufficient to deliver positive returns from stocks in 2022. However, given the challenges we outlined above, 2022 looks more like a year of single-digit total returns for broad equity markets rather than a repeat of the extraordinary returns investors have enjoyed over the last three years. Fortunately, our investment opportunities are not constrained to broad market indices and with the historically wide valuation dispersion among stocks, we feel optimistic about our prospects in the new year.

Fort Pitt Capital Group (FPCG) is an investment advisor registered with the United States Securities and Exchange Commission (“SEC”). For a detailed discussion of FPCG and its services and fees, see the Form ADV Part 1 and 2A on file with the SEC at www.adviserinfo.sec.gov. Registration with the SEC does not imply any level of skill or training. You may also visit our website at www.fortpittcapital.com.

Any opinions expressed are opinions held at the time of publishing and are subject to change. It does not constitute an offer, solicitation, or recommendation to purchase any security. The information herein was obtained from various sources; we do not guarantee its accuracy or completeness. Past performance does not guarantee future results. The performance shown is for illustrative purposes only and the intent is to show the performance of certain segments of the fixed income markets. This information is not reflective of the performance of any FPCG client, or the impact of security selection on actual client portfolios.

Bond yields are slightly higher to begin the year but still extremely low in absolute terms. Interest rates are likely to grind higher in 2022, driven by Fed rate hikes, dramatically lower support from central bank bond purchases, and elevated inflation levels. Last year we stated that fixed income investors would be lucky to earn their coupon/yields on bonds in 2021. With most bond market indices finishing the year in negative territory, that prediction was accurate. We’ll stick with the same call for 2022.