How to Calculate Your Net Worth

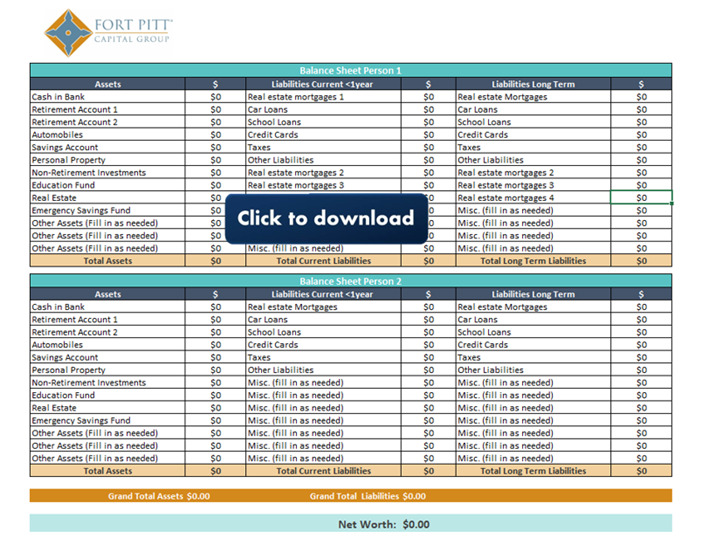

Calculating net worth is essential for businesses and individuals. It’s how you determine your monetary value, considering your assets and liabilities. Fort Pitt Capital Group helps families and business owners manage their finances to grow their net worth. In this article, we’ll cover net worth, how to calculate it, and why knowing your net worth is important. You can click here for a free downloadable net worth spreadsheet that will help you with this task. Go to the second tab’s Personal Balance Sheet.

What Is Net Worth?

Net worth is the combination of what you owe and own. Your net worth provides a bird’s eye view of your financial situation.

You may look at your net worth and realize everything is wonderful — you own more than you owe. That means you can start strategies that build your net worth further. On the other hand, your net worth could show that you owe more than you own. That’s fine — balancing debt is a part of life. It’s up to you to make a plan and grow your net worth.

How to Calculate Net Worth

To calculate your net worth, you will need to add the total value of your assets and liabilities together. Then, subtract your liabilities from your assets. If your assets equate to more value than your liabilities, then you have a positive net worth. The opposite is true when liabilities outweigh assets.

However, tallying your assets and liabilities isn’t as simple as counting the quarters in your piggy bank. Your assets and debts are spread across numerous accounts. The value of some assets may vary by the day, while others steadily appreciate or depreciate over time. You will have to investigate the value of each asset and liability under your name independently. In many cases, this will require you to log into various accounts or check with relevant organizations.

Net Worth for Business Owners

A business’s net worth is its book value or the product of its balance sheet. Balance sheets contain financial statements that report the company’s assets, liabilities, and shareholders’ equity — the amount each shareholder would receive if the business sold all assets and paid off all debts.

Businesses keep balance sheets to easily measure and report success. Information on a balance sheet can tell decision-makers what they should prioritize.

Balance sheets also provide valuable information to shareholders. Shareholders want to know their investment is producing value. Providing the net worth allows the business to prove its worth. A publicly traded company with a rising net worth will likely see its stock prices rise.

Lenders consider net worth as well. A lender will assess an applicant’s balance sheet and are more likely to approve loans for a company with a positive balance sheet.

Business assets and liabilities include:

| Assets | Liabilities |

| Cash | Loans and credit lines |

| Certificates of deposit | Interest payable |

| Hard currency | Wages payable |

| Accounts receivable | Dividends payable |

| Inventory | Pension funds |

| Land and buildings | Deferred tax liability |

| Equipment | Credit card balances |

| Intellectual property and copyrights | Leases |

| Prepaid expenses | Mortgages |

Net Worth for Individuals

An individual’s net worth is a valuable figure to know when managing personal finances. Your personal net worth is how much money you would have remaining if you sold all of your assets and possessions and then repaid all your debts.

Personal net worth largely rides on the high-value assets under your possession. For instance, a home holds significant weight when determining a person’s net worth because it is one of the most expensive investments an individual can make. Purchasing a home will help your net worth grow because the total loan value remains the same, while the home’s value will likely increase over time. Other successful investments in stocks, bonds, mutual funds, and other sources can also make or break your net worth.

Common assets and liabilities to include when determining an individual’s net worth include:

| Assets | Liabilities |

| Bank accounts | Private loans |

| Investments | Federal loans |

| Real estate | Accounts payable |

| Cars | Mortgages |

| Personal property | Credit card balances |

| Insurance policy cash value | Bills |

| Taxes |

Determining What Is a Good or Bad Net Worth

On a basic level, one might consider “good net worth” as a positive balance between assets and liabilities, while “bad net worth” as when you have more liabilities than assets. But within this dichotomy, there is room for analysis.

Your net worth may be in the red at the moment while showing a steady upward trend. A negative or low net worth is common for new families and startup businesses that incur debt in the short term for long-term benefits.

Likewise, you could achieve a high net worth but start a downward trajectory. Monitoring net worth allows individuals and businesses to understand their financial situations and develop plans that promote growth.

Work With Fort Pitt Capital Group

Net worth is what you own minus what you owe, and it’s important to know. You can calculate your net worth by adding the value of all assets you own and then subtracting the sum of your debts from that figure. Fort Pitt Capital Group is here to help you take control of your net worth. We offer various wealth management services for individuals and business owners. We encourage you to contact us online for more on our wealth management offerings.