Charitable Giving: Making a Lasting Impact Through Donations

*Scroll down for the full video.*

My name is Chris Chaney. I am a senior financial advisor with Fort Pitt Capital Group. We are a money management firm with offices in Pittsburgh, Harrisburg, and Naples, Florida. We provide comprehensive, planning-based portfolio management for individuals, institutions, businesses, and endowments across the country. Our sole focus is to help clients make the most of their money. I am also a Certified Exit Planner. I specialize in working with business owners to help them realize their unique goals.

The wonderful thing about charitable giving is it allows you to do great good for your causes, the things that are important to you, but there can also be material financial benefits.

There are three basic ways that you can give. The first is a direct, immediate contribution. The second is a direct deferred contribution. And the third is structured gifts. There are three basic ways. I will take each category and break them down for you so that you can see how they specifically apply to you.

So we’re all familiar with probably the most direct way that we give and most frequently give, and that’s cash. Writing a check, actually making a cash deposit, or, nowadays, just going online on an app and giving. A wonderful way to give and it provides an immediate tax deduction, probably the most impactful tax deduction you’ll have, just by giving direct cash. It’s direct and immediate because you’re giving directly from your pocket to the pocket of the charity. That’s the first type.

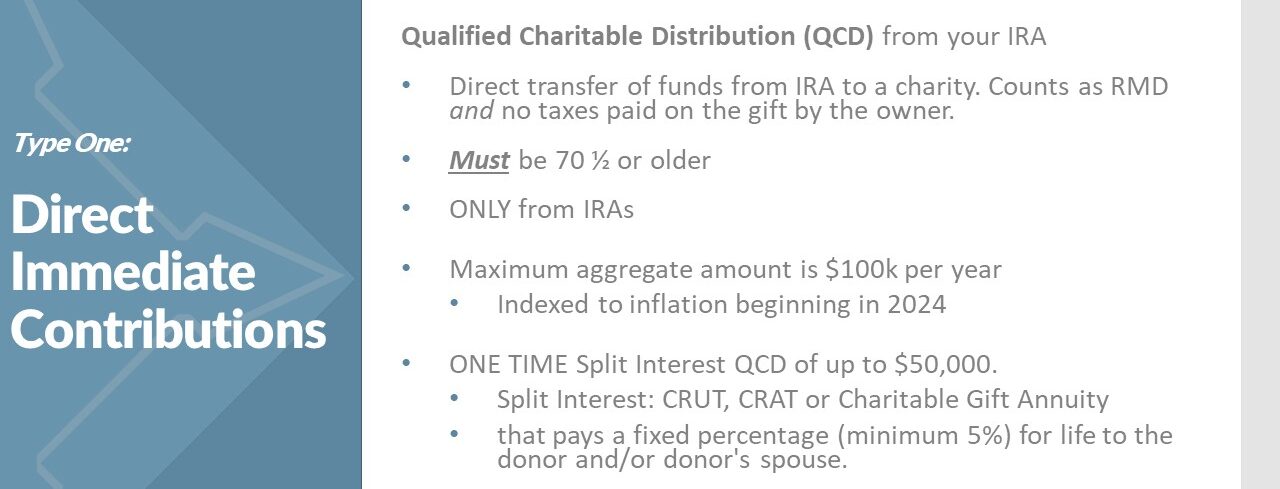

The second is a qualified charitable distribution. A qualified charitable distribution or QCD is done from a retirement account. Now, this is done from an IRA and an IRA only. You can’t do it from a 401k. You can do it from your IRA. If you are currently in the stage where you’re required to take minimum annual distributions from your IRA, right now that’s age 73 or older, the federal government requires you to take a certain portion of your portfolio, your IRA, every year, you can direct up to $100,000 of that required minimum distribution or RMD to the charity of your choice. The wonderful thing about this contribution, again, is that it is direct from your IRA and goes directly to the charity or charities of your choice. There’s no specific limit or threshold as to the specific amount of the gift, other than the fact that you can only give a total of $100,000 per year, that’s your maximum, to a charity.

And if you’re married, you can do the two; each of you can do $100,000. But it has to go directly from the IRA to the charity, hence direct. That’s the second cut. The great advantage of doing this is it satisfies your charitable intent, but on top of that, it also takes that out of your taxable income. You want to make sure of two things. When you make a QCD, the charity needs to send you a letter in a timely fashion indicating a receipt of the gift. That’s your record. It’s the charity’s obligation to ensure they acknowledge that gift. They have to acknowledge it. It’s important to keep that for your records. In all cases, when you’re making a charitable gift, it’s really important to keep detailed records of those gifts. You will need that when you file your taxes. The third way that you can give is appreciated securities. The wonderful thing about giving appreciated securities is that you can give the full value of that stock or other type of security that’s highly appreciated and not pay capital gains on it but give that full value to the charity. And because they are a non-profit, they don’t pay taxation on the capital gain. You get the tax deduction based on the full value of that contribution. The charity gets the full value of it, and no capital gains are paid. Therefore, more money gets put to work. It’s a wonderful option available to you in terms of giving.

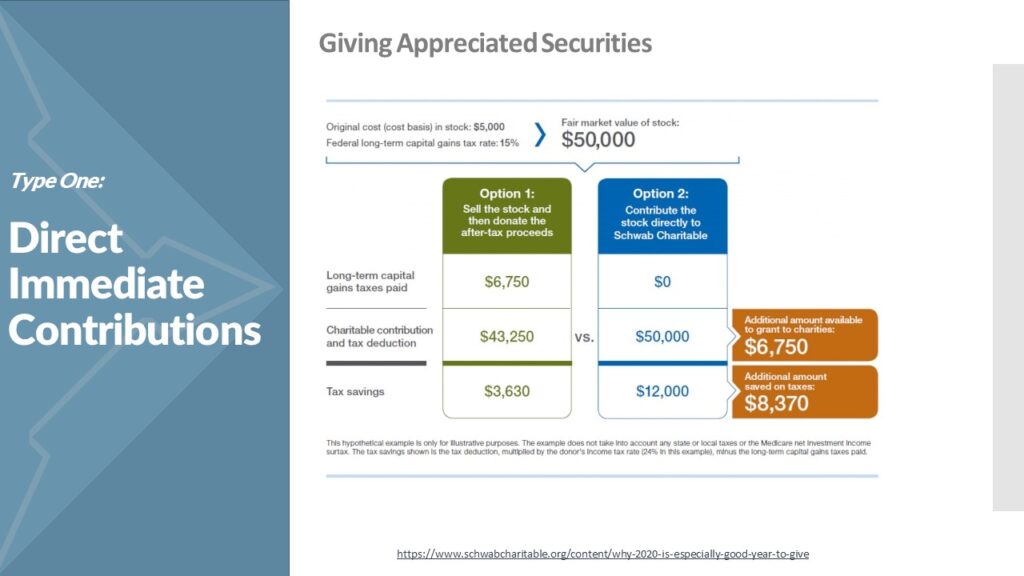

As I mentioned, you avoid capital gains, you receive a tax deduction, but it can be quite a material difference. Here’s an example. Let’s suppose you’ve got somebody who is in the 24% tax bracket. If they had a $50,000 investment that they paid $5,000, so we call that a basis of $5,000, they would have a capital gain, the difference between their basis and the current value, of $45,000. If they cashed out the security first before writing the check, in this case, to the charity, you would pay $6,750 in capital gains. That’s a 15% tax on this $50,000 sale. Now, they’ve only got $43,250 to work with. They then write the check for that sum to the charity, and they get a tax savings, as you can see, of $3,630. Now, that’s a wonderful gift, but what happens if we could take the security and not sell it? And that’s actually what happens here with option two. You gift the entire sum, all $50,000. There are no capital gains. The charity is a qualified 501c3 charity. They don’t pay taxes. As a result, the full value of that gift is made. $50,000 is contributed. That’s $6,750 more to the charity than you would have given otherwise. And it results in a much larger tax deduction. That’s a full $12,000 of tax savings, $8,370 more than you would have gotten from selling the stock first. Why is that? Because you paid the capital gains on the one hand, which you didn’t have to pay this time, and you got a larger gift. The combination of avoiding the taxes paid and, at the same time getting a larger gift and, therefore, a larger production results in a significantly increased total tax savings. And this year, unlike last year, there was an opportunity to do that. If you’ve been able to participate in some of the mega cap tech stocks that have really rallied this year, there are quite a few out there that have had significant gains this year. This might be an excellent stock to give to the charity of your choice.

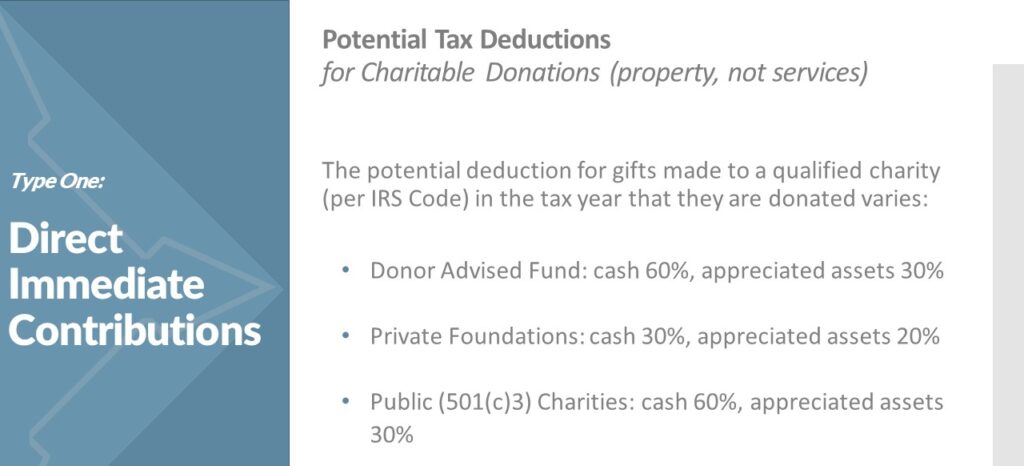

Those are the potential tax deductions. Now, there are also tax deductions for property. These are going to vary based on the tax year in which they’re donated. Let’s talk about giving to not necessarily a charity directly, but to a donor advised fund. You’re going to have a limit in terms of the amount that you can deduct for cash versus appreciated assets. What does that mean? That means that you’re going to hit a limit as to how much you can actually deduct against your taxes. The donor advised fund is a way to pool your gifts. You give it to the donor advised fund. It separates the giving from the recipient. You can cluster your gifts in one year and then distribute them over time. Private foundations have different limits- up to 30% on appreciated assets. And then, if you give to a public charity, it’s currently 60% on cash and 30% on public, appreciated assets.

Having said that, if you’ve got an excess gift that you give, you can carry it forward for the next number of years. And that will allow you to use it in future years if you can’t use it all up in the current year just because you’ve hit your limits. Obviously, when we’re talking about taxes and tax laws, tax rules and limits are constantly changing. Please, it’s critical that you consult with your tax advisor to see what the tax impact of any charitable decision would be. If you’ve already got charitable intent, make the gift. If this is part of a tax planning strategy, talk to your tax advisor first and see which strategy makes the most sense for you. Obviously, if you hit different limits, you want to consider which type of charity you want to give to.

Now, as I mentioned, if you’re dealing with a qualified charitable distribution, it’s got to be a direct transfer. The IRA counts against your RMD, which is a great thing, counts against that required distribution. You’re not paying taxes on it. This is key. You do have to be 70 and a half or older, and that 70 and a half is strict. It’s only coming from IRAs. The total aggregate value that you can gift in any given year is $100,000. Now, beginning next year, it will be indexed to inflation. That amount that will be permissible to give will grow over time.

Watch the video to find out more!