How to Change Financial Advisors

Are you experiencing strained communication with your current financial advisor or noticing poor portfolio performance? These may be signs that it’s time to change financial advisors. Switching can often be a good choice because it may lead to improved communication and better financial planning. This guide explores reasons to switch financial advisors and steps you can take for a smooth transition from your current advisor to a new one.

Reasons to Change Financial Advisors

Before making the switch, evaluate the issue to understand what type of advisor to look for next. Here are five signs it’s time to switch financial advisors.

You Need Personalized Advice

Does the advice you receive feel generic or unchanging, even as your financial situation evolves? This could indicate that your financial advisor isn’t fully grasping your unique circumstances or lacks the expertise to provide tailored guidance.

For instance, if you’re nearing retirement, you likely need advice focused on income distribution and tax-efficient withdrawals, not continued aggressive growth investing. Similarly, a significant life event like remarriage requires specific advice on combining finances, updating beneficiaries, and optimizing accounts for a new household.

You Want a Fiduciary Advisor

A fiduciary advisor operates under the highest legal and ethical standard, requiring them to always act in your best interest, ahead of their own or their firm’s. This means their advice is solely based on your unique financial situation and needs, irrespective of how it impacts their compensation. Ask yourself: Does your current advisor consistently prioritize your interests? Are they recommending products like specific insurance policies or annuities without thoroughly explaining why they suit your situation? Have they steered you towards investments that primarily benefit them through higher commissions or fees, rather than offering the most appropriate options for your financial goals? If you suspect a conflict of interest or if your advisor isn’t transparent about their compensation structure, it may be time to seek a fiduciary advisor

Your Advisor Doesn’t Adapt to Market Conditions (or Your Risk Tolerance)

A financial advisor should be able to help you set realistic expectations that align with current stock market conditions and your long-term goals. If your advisor is consistently setting unrealistic performance targets, or if your portfolio performance consistently falls short of reasonable benchmarks for your risk profile over an extended period (beyond typical market fluctuations), it might be time to find a more knowledgeable and adaptable advisor who can help you set and achieve appropriate investment goals.

You Hesitate to Call Your Financial Advisor

Your relationship with your financial advisor should be built on trust and accessibility. If you find yourself hesitating to reach out with questions or concerns, feeling as though your issues are trivial, or that your advisor is too busy for you, it’s a significant red flag. Signs like rushed conversations, unreturned calls for days, or feeling undervalued generally indicate your advisor isn’t prioritizing your needs. You deserve an advisor who makes you feel heard, respected, and equally important to their practice.

Your Financial Advisor Has an Incompatible Trading Philosophy

Do you prefer long-term approaches, but your financial advisor wants you to focus on short-term profits? Even if it’s the other way around, a difference in trading approaches can hinder you from receiving the advice you need. For example, they may brush off your ideas or make you feel it’s unreasonable to question a professional in the field.

Ideally, you should work with someone who listens and sees your idea eye-to-eye. The right financial advisor will research your idea and adjust to help you reach your goal. Otherwise, they’ll explain why the idea won’t work with proof and offer suitable alternatives.

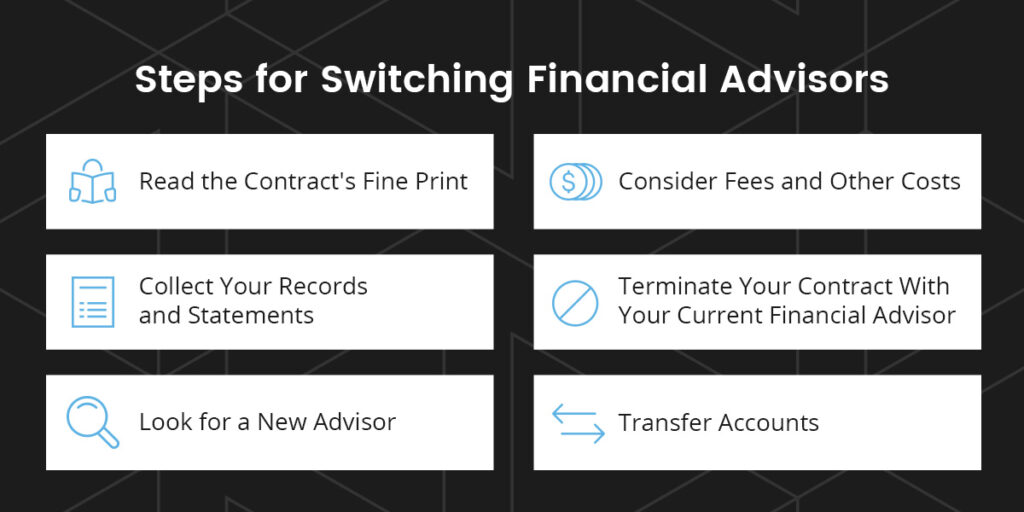

Steps for Switching Financial Advisors

Here are six steps you can follow when changing financial advisors.

1. Read the Contract’s Fine Print

First, you should review your current contract for the clause on how to terminate it. This is important since termination can differ depending on your financial advisor. For example, some may request a termination fee, while others require a signed letter.

2. Collect Your Records and Statements

Gather all current and past investment information to ensure a seamless transition and provide your new advisor with a complete picture of your financial situation. While your new financial institution will typically initiate the transfer of your assets (often via the Automated Customer Account Transfer Service, or ACATS, for eligible accounts), having your own copies of key documents is crucial for your records and verifying the transfer’s accuracy. Essential documents to collect include:

- Recent account statements (investment, banking, retirement)

- Transaction history

- Cost basis information for all taxable securities (crucial for tax planning)

- Annuity contracts and insurance policy binders

- Retirement plan details (401k, IRA, etc.)

- Estate planning documents (will, trusts, power of attorney), if applicable

3. Look for a New Advisor

Begin your search for a new advisor. Beyond online searches for local advisors, consider asking for referrals from trusted friends, family, or other professionals (like CPAs or attorneys). When contacting potential advisors, schedule initial consultations to discuss their specialties, core values, investment philosophy, fee structure, and how they communicate with clients. Use this opportunity to ask specific questions based on what you disliked about your previous advisor’s services, aiming to prevent similar issues. Don’t hesitate to interview several advisors to find the best fit. Additionally, check their professional credentials and regulatory disclosures (e.g., through BrokerCheck or the SEC’s Investment Adviser Public Disclosure database) and review online testimonials or firm reviews.

4. Consider Fees and Other Costs

Understanding all potential costs associated with switching advisors is critical, as these can impact your overall returns. Discuss the following with any prospective advisor:

- Tax consequences: Be aware that selling existing securities to transfer them (e.g., if they are proprietary to your old firm or you’re changing account types) could trigger capital gains taxes. Your new advisor should help you understand these implications and explore strategies to minimize tax bills.

- Advisor fees: Clarify their compensation model: Do they charge a percentage based on assets under management (AUM), an hourly rate, a fixed service fee, or product commissions? Ensure you understand how their fees are calculated and disclosed.

- Other Potential Fees: Carefully review all disclosures for additional costs such as trading fees, custodian fees, mutual fund expense ratios, or commissions on specific products. Transparency about all fees is a hallmark of a good advisor.

- Non-Transferable Assets/Proprietary Products: Ask your new advisor to help you identify any assets held with your current firm that are proprietary or cannot be easily transferred “in kind” (i.e., transferred as they are without being sold). Examples might include certain annuities, alternative investments, or specific mutual funds only offered by your current firm. You may need to liquidate these assets and transfer them as cash, which could incur surrender charges or tax consequences. Understand these costs and discuss the best action for these specific holdings.

5. Terminate Your Contract With Your Current Financial Advisor

While your new advisor will typically initiate the account transfer process, which often serves as formal notification, informing your current advisor of your decision can be beneficial. This lets you formally inquire about any outstanding fees or potential termination costs. Providing constructive feedback on your reasons for leaving can also be valuable for their future client service, though you are not obligated to do so.

6. Transfer Accounts

Once you are aware of all costs and next steps and know which advisor to go with, have your new financial advisor transfer your accounts. Remember that you’ll have to liquidate nontransferable assets and then transfer them as cash. It may take a few days to weeks until the process is complete.

Switch to a Financial Advisor at Fort Pitt Capital

Finding the right financial advisor can significantly enhance financial planning and investment outcomes. At Fort Pitt Capital, we are dedicated to providing knowledgeable and experienced financial advisors who prioritize your best interests. We uphold our fiduciary responsibility through transparent communication and individualized financial advice tailored to your circumstances. Our investment strategies focus on prudent risk management, aiming to mitigate the impact of market declines while optimizing long-term returns aligned with your goals. To learn more about how we can support your financial journey, contact our knowledgeable professionals today.