Seven Smart Tax Saving Tips

Fort Pitt Captial Group’s Financial Advisor Beth Lynch, CFP®, educated high-income earners about smart tax-saving tips and strategies to implement in the new year.

View the webinar or scroll down to read the transcripts.

- There aren’t any earth-shattering new tax laws for 2024.

- Most of the changes are inflation adjustments and new limits.

- Federal Tax brackets and tax rates:

- The 7 tax bracket remain unchanged (10%, 12%, 22%, 24%, 32%, 35% & 37%

- However, the income thresholds have moved up. For example, married filing jointly: the 24% tax rate for 2023 was $190,751 to $364,200 for 2024, the threshold is 201,051 to $383,900

- The Standard Deduction will increase by $750 for single filers and Married filing jointly will increase by $1500

- Gift tax exclusion for 2024 will increase to $18,000 per person, up $1000 from 2023 and those with estates below $13.6 million will not be subject to estate tax, this is up from $12.92 M in 2023

- HSA (Health Savings Accounts) the contribution limits for 2024 will rise to $4,150 for individual coverage and $8,350 for family.

Again, no major changes so far, but it seems like Congress loves to pass bills at the end of the year, such as the Secure Act and Secure 2.0, which were both passed at the end of December. With that said, let’s talk about how you can save more for your retirement and pay less in taxes and why you should Max out your employer retirement plan.

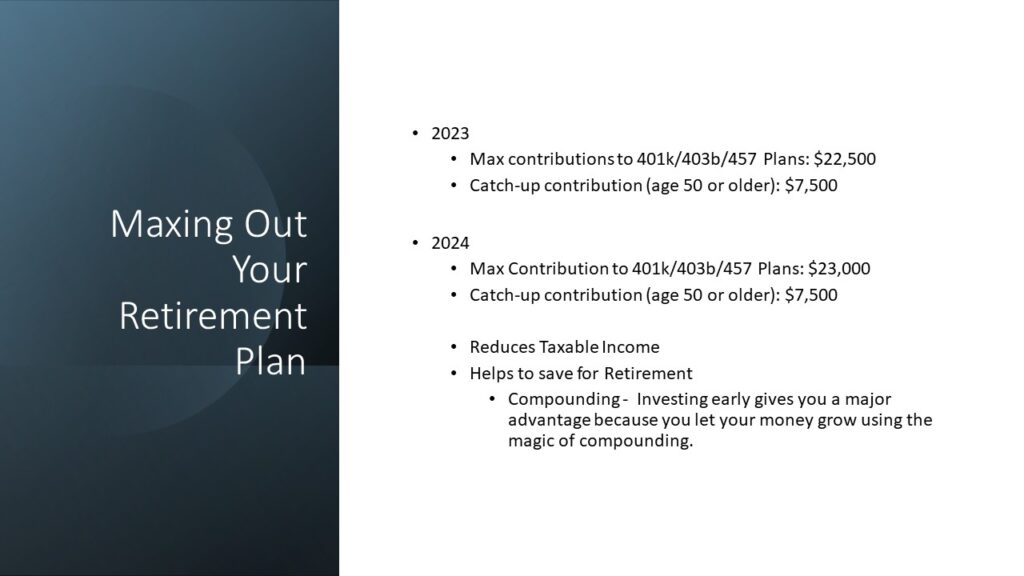

1. Maxing Out Your Retirement Plan

- 2023

- Max contributions to 401k/403b/457 Plans: $22,500

- Catch-up contribution (age 50 or older): $7,500

- 2024

- Max Contribution to 401k/403b/457 Plans: $23,000

- Catch-up contribution (age 50 or older): $7,500

- Reduces Taxable Income

- Helps to save for Retirement

- Compounding – Investing early gives you a major advantage because you let your money grow using the magic of compounding.

- Saving into your ER Plan is dollar cost averaging. Plus, many plans have a company Match.

- Secure 2.0 had originally noted that for anyone making over $145K, the catch-up contributions must be saved into a Roth. This has now been extended to begin in 2026.

- Roth’s aren’t bad though, this is a way for high income earners to put money into a Roth, that they would not be able to contribute to outside of their employer plan due to income limits. For example, in 2024 if you are single Roth IRA contributions are phased out at $146,000 and eliminated if you make more than $161,000. For married filing jointly, the phaseout is $230K – $240K.

- Roth contributions are made with taxable dollars but grow tax free and can be withdrawn tax free. This gives you more buckets to withdraw from in retirement.

- Looking at your taxable income and other income, it could make sense for you to do a portion of your 401k contribution to both the traditional pre-tax and some to the Roth. If you are able to have some funds directed to the Roth without putting yourself into the next tax bracket this would be wise.

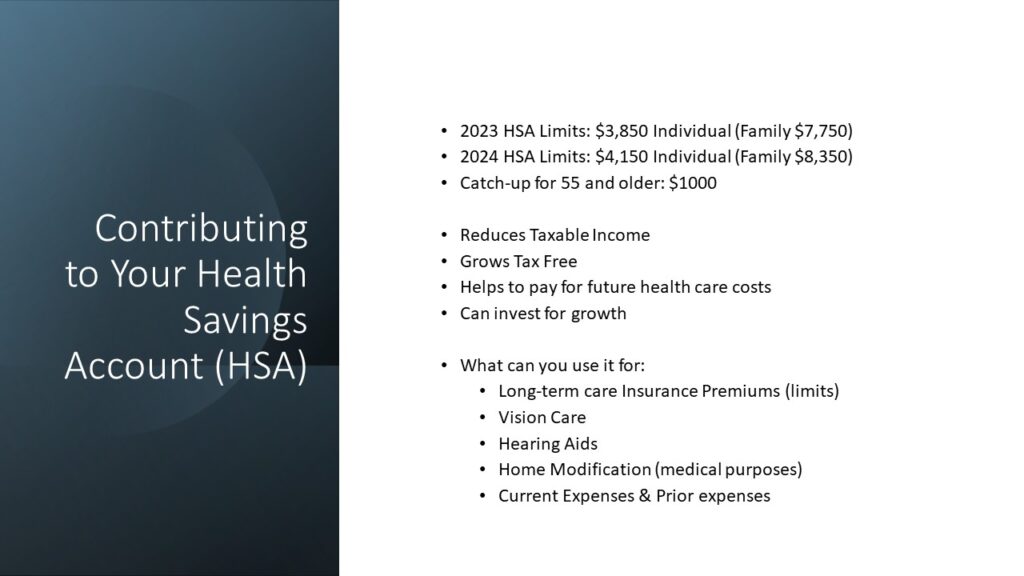

2. Contributing to Your Health Savings Account (HSA):

- 2023 HSA Limits: $3,850 Individual (Family $7,750)

- 2024 HSA Limits: $4,150 Individual (Family $8,350)

- Catch-up for 55 and older: $1000

- Reduces Taxable Income

- Grows Tax Free

- Helps to pay for future health care costs

- Can invest for growth

What can you use it for:

- Long-term care Insurance Premiums (limits)

- Vision Care

- Hearing Aids

- Home Modification (medical purposes)

- Current Expenses & Prior Expenses

3. 529 Plans

Front Loading $18K per year for a 5 year forward or loading $90,000

- Grandparent vs. parent owners:

- 529 plans are a popular way for grandparents to save for college, and for good reason. With a 529 plan, you can build an educational legacy for your grandchild while taking advantage of tax and estate planning benefits.

- FAFSA changes are set to take place for the 2024-25 award year, now is the time to set up a 529 plan for a grandchild who isn’t currently in school. You can start accumulating assets for them that won’t hurt their financial aid ability when they enroll.

- Overall, 529 plans have a minimal effect on financial aid. But, the FAFSA used to treat parent-owned accounts more favorably.

- For example, you report 529 plan assets as parent assets, which can only reduce aid eligibility by a maximum of 5.64% of the account value. The FAFSA ignores distributions from a parent-owned 529 plan.

When it came to a grandparent-owned 529 plan, you did not report the assets on the FAFSA, but had to report distributions as untaxed student income. Untaxed income to a student can reduce aid eligibility by as much as 50% of the amount of cash support.

For example, taking a $10,000 529 plan distribution to help pay for college can reduce your grandchild’s aid eligibility by $5,000, under the previous rules.

This is why it’s such a big deal that the rules are changing. Now, a grandparent will be able to open a 529 plan for their grandchildren and all of the same benefits that parents currently enjoy will be passed on to these accounts.

Additional PA 529 Plan Information:

- Tax Free Growth /Tax Free Withdraws for Qualified Expenses

- State Income Tax Deduction ( 30 states allow)

- State determines max. tax deduction

- Pennsylvania state income tax deduction– Pennsylvania taxpayers can deduct up to $17,000 in contributions per beneficiary per year ($34,000 if married filing jointly, assuming each spouse had income of at least $17,000) from their Pennsylvania taxable income for the purposes of determining their state income taxes.

- PA one state that allows a deduction no matter what state plan you fund

- Federal gift tax – You can contribute up to $85,000 in a single year ($170,000 for a married couple filing jointly) for each beneficiary without incurring federal gift tax. The amount contributed is prorated over 5 years so, for example, a $30,000 contribution would use $6,000 of the current $17,000 annual gift tax exclusion each year for 5 years. – 2023 In 2024 this increases to 18,000.

- Federal estate tax– If you die with money remaining in your account, it will not be included in your estate for federal estate tax purposes. However, if you choose to take advantage of the federal gift tax averaging option mentioned above and you die within five years of contributing, a prorated portion of the contribution will be subject to estate tax.*

- Pennsylvania inheritance tax– Funds in the account are exempt from Pennsylvania inheritance tax. Depending on the relationship between the deceased account owner and the heirs, this can be a savings of up to 15% of the entire value of the account.

Qualified Expenses for a 529 :

- College, graduate, or vocational school tuition and fees

- Elementary or secondary school (K–12) tuition and fees (Limit applies)

- Books and school supplies

- Student loan payments (Limit applies)

- Off-campus housing

- Campus food and meal plans

- Computers, internet, and software used for schoolwork (student attendance required)

- Special needs and accessibility equipment for students

4. Invest in Individual Stocks vs Mutual Funds in Taxable Accounts

When investing in taxable accounts, it’s important to understand the tax ramifications of the types of securities that are in your account. Some are more tax-efficient than others.

For example, if you are holding individual stocks, you may not owe any taxes on those securities, assuming you have not sold them and they do not pay dividends. – most growth stocks.

However, let’s assume you do sell them, you would then pay a capital gains tax on the gain. These rates are lower than ordinary income rates. Currently, the long–term capital gains rates, based on income, are 0%, 15% or a max. of 20%.

You have control over what you sell and when you sell it. Short-term gains are taxed at ordinary income rates.

- You can also offset gains by taking losses on other securities – again, you can control your taxable gains.

- We do quite a bit of tax loss harvesting in our clients’ taxable accounts. We have capital gains budgets so clients can have an idea of how much they could owe in taxes based on realized gains.

- Mutual funds, on the other hand, do capital gain distributions. This means if they have placed trades throughout the year, they are required to pay out those gains to their shareholders in the form of a capital gains distribution. These usually happen in November and December. You have no control over how much to take in gains. So, you could have a surprise tax bill even in a down market year.

- Understanding how your investments are taxed is very important.

So, what strategies can you use to save on taxes:

- Tax loss harvesting

- Taking Losses to offset Realized Capital Gains

- Carryover loss to future years

- Up to $3,000 deduction in current year above offset

- Cash : giving from your savings

- Enjoy a tax deduction

- Appreciated Securities: giving from your portfolio

- Avoid capital gains tax on the appreciation

- Receive a tax deduction

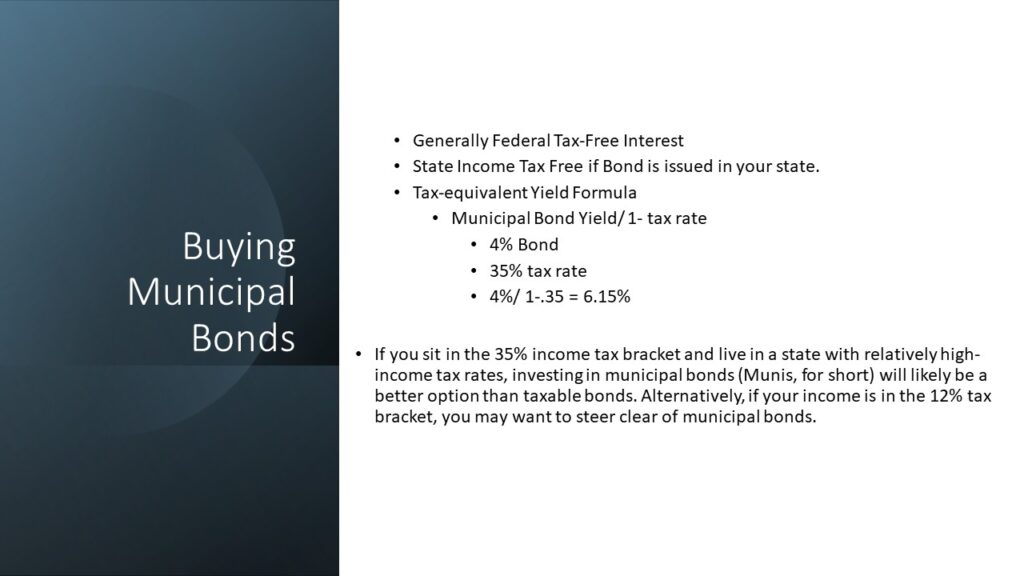

5. Buying Municipal Bonds

Bonds have been a hot topic lately. With the Fed raising rate, we have finally seen higher coupons on Bonds. Municipal, or “Munis,” can be a way to invest in fixed income and enjoy tax-free interest. Muni bonds are not for everyone. You should discuss whether they are a fit for you with your financial advisor and or CPA.

- Generally, Federal Tax-Free Interest

- State Income Tax Free if the Bond is issued in your state.

- Tax-equivalent Yield Formula

- Municipal Bond Yield/ 1- tax rate

- 4% Bond

- 35% tax rate

- 4%/ 1-.35 = 6.15%

- Municipal Bond Yield/ 1- tax rate

If you sit in the 35% income tax bracket and live in a state with relatively high income tax rates, investing in municipal bonds (Munis, for short) will likely be a better option than taxable bonds. Alternatively, if your income is in the 12% tax bracket, you may want to steer clear of municipal bonds.

The coupons may look lower than corporate bonds. This is due to the fact that the interest is tax-free. So, how do you figure out what the tax-equivalent yield is for a Muni bond?

6. Charitable Giving Setting up A Donor Advised Fund/ Qualified Charitable Contributions

Many Ways to give:

- Cash/Checks- Direct Donations

- Appreciated Stock

Donor Advised Fund:

- Fund now with appreciated securities, get a deduction

- Distribute at a future date

Qualified Charitable Contributions- QCDs

Donor Advised Fund or DAF: Opening or contributing to a DAF is appealing to many as it allows for a tax-deductible gift in the current year and also the ability to dole out those funds to charities over multiple years.

This is where bundling can come in – perhaps you make a large gift in one year, tax the deduction because it’s over the standard deduction, ie, you itemize, then the following year, you take the standard deduction.

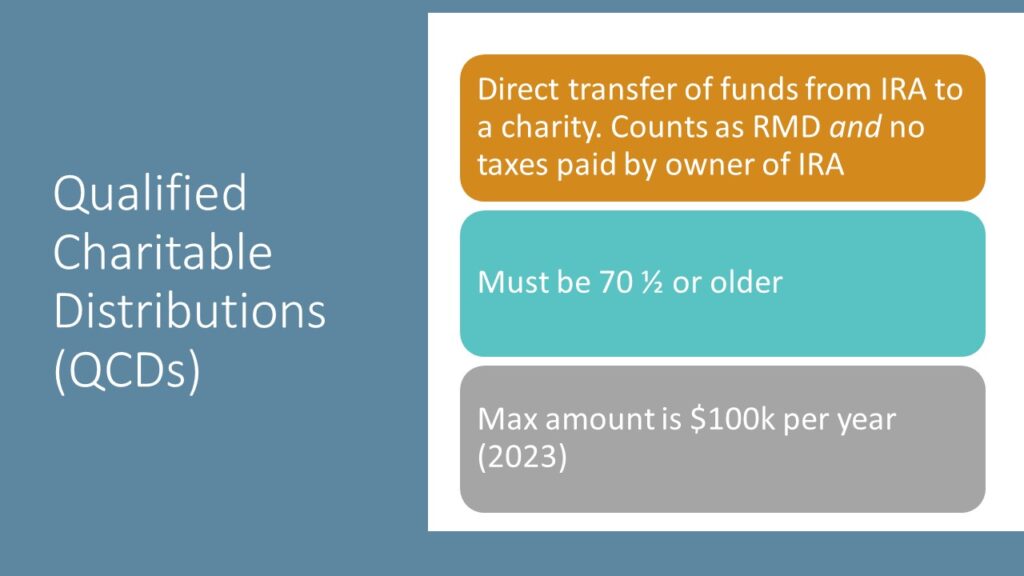

Qualified Charitable Distributions (QCDs)

- Direct transfer of funds from IRA to a charity. Counts as RMD and no taxes paid by owner of IRA

- Must be 70 ½ or older

- Max amount is $100k per year (2023)

- Starting in 2024, the $100,000 will be indexed for inflation.

- So 2024 QCD limit is $105,000.

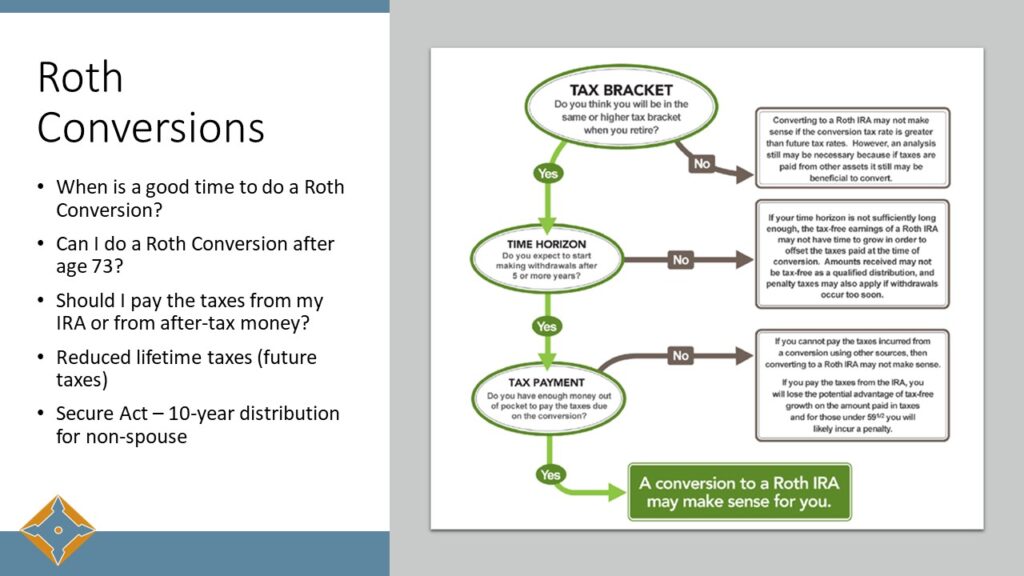

7. Last but surely not least is Roth Conversions.

- When is a good time to do a Roth Conversion?

- Can I do a Roth Conversion after age 73?

- Should I pay the taxes from my IRA or from after-tax money?

- Reduced lifetime taxes (future taxes)

- Secure Act – 10-year distribution for non-spouse

When is a good time to do a Roth Conversion:

- Any money converted from a traditional IRA to a Roth IRA will be taxed as Ordinary income (based on your tax bracket), so it makes sense to do a conversion during a year when your income is unusually low.

- Another good time to convert from traditional to Roth is when the market is down and your traditional IRA has lost value, and/or your income is unusually low.

About Beth Lynch, Fort Pitt Capital Group Financial Advisor:

Hungry for more? Try: