Understanding The Different Types of Financial Advisors

Financial advisors can help you pursue your financial goals through investments, tax planning, retirement planning, or other strategies suitable for your current life situation. They plan based on what matters most to you. Plus, they can help you build the appropriate spending and saving habits to get you closer to those goals.

However, people can claim to be financial advisors without proper certifications. With so many individuals claiming to be financial advisors, how can you discern who is legitimate and protect your hard-earned money? This article is your guide to finding the right financial advisor for your unique needs.

Try our matching tool to find the right advisor with the qualifications to help in your specific situation.

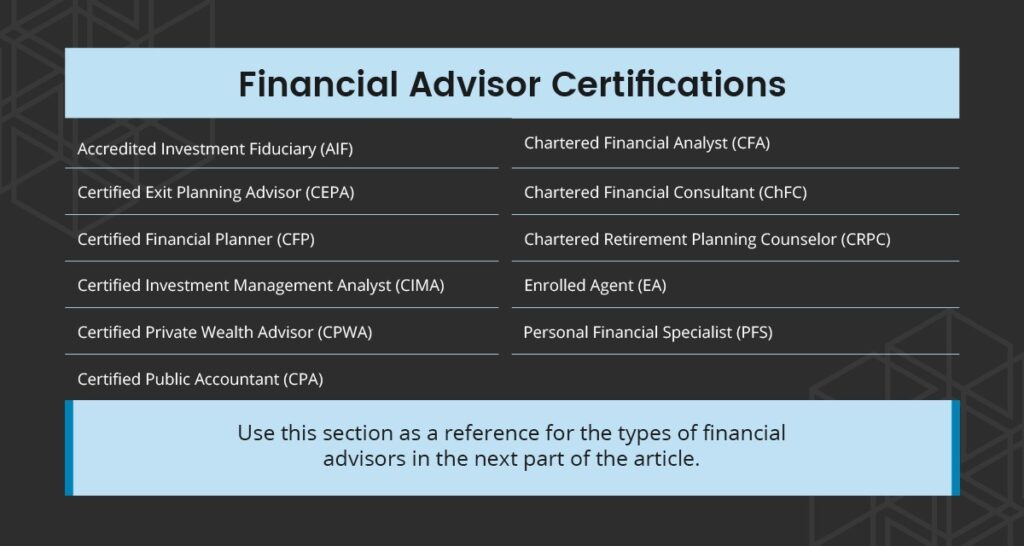

Financial Advisor Certifications and What They Mean

Learning the most important certifications to look for in a financial advisor can help ensure you get the services that you need.

The required certification depends on the financial advisor’s job. Websites like BrokerCheck and Investment Advisor Public Disclosure can help you look up an advisor’s level of experience or whether they have any disciplinary history that you should be aware of. You can also use this database to verify a firm’s SEC registration.

For example, if you want to check if a financial advisor you are interested in hiring is a Certified Financial Planner, look up their name on the CFP website. Below you’ll find various types of financial advisor designations and the certification’s acronym.

| Certification | Issuing Organizationr |

|---|---|

| Accredited Investment Fiduciary (AIF) | Center for Fiduciary Studies |

| Certified Exit Planning Advisor (CEPA) | Exit Planning Institute |

| Certified Financial Planner (CFP) | Certified Financial Planner Board of Standards, Inc. |

| Certified Investment Management Analyst (CIMA) | Investments & Wealth Institute |

| Certified Private Wealth Advisor (CPWA) | Investments & Wealth Institute |

| Certified Public Accountant (CPA) | Boards of Accountancy |

| Chartered Financial Analyst (CFA) | CFA Institute |

| Chartered Financial Consultant (ChFC) | The American College of Financial Services |

| Chartered Retirement Planning Counselor (CRPC) | College for Financial Planning – a Kaplan Company |

| Personal Financial Specialist (PFS) | The American Institute of Certified Public Accountants (AICPA) |

For informational purposes only. The achievement of any professional designation should not be construed as a guarantee that a client will experience a certain level of results or satisfaction if Fort Pitt is engaged, or continues to be engaged, to provide investment advisory services.

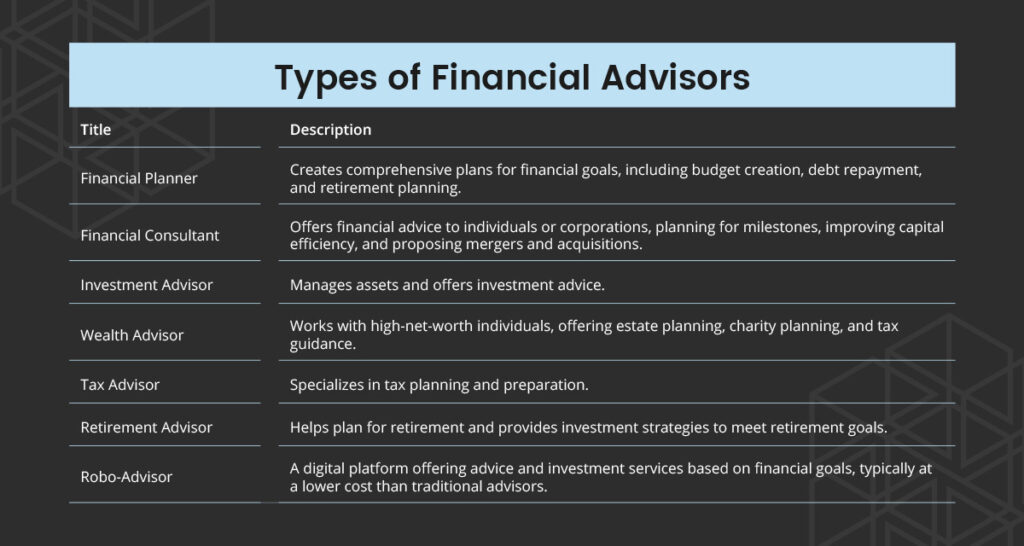

What Are the Various Types of Financial Advisors?

Financial advisors’ designations vary, affecting their job titles and what they can do for you. Here are the standard titles and how they can be relevant to your situation:

- Financial planner: As the title suggests, financial planners create comprehensive plans to help you achieve your financial goals. These plans can involve budget creation, debt repayment planning, or retirement planning. Look for a CFP as they have undergone training and have passed the certification exam. Not all financial planners are CFPs.

- Financial consultant: Financial consultants offer financial advice to individuals or corporations. They can help individuals plan for milestones like buying a home or paying for education. They can help companies improve their capital efficiency and shareholder value, including designing compensation strategies or proposing mergers and acquisitions. Required certifications vary depending on the services they offer. You can consider a CFP, a ChFC, or a CFA, among other certified professionals.

- Investment advisor: Investment advisors can manage your assets and offer investment advice. Various licenses apply, but you can look for a CFA or any investment advisor registered with your state or the SEC.

- Wealth advisor: Wealth advisors usually work with high-net-worth individuals and have minimum investment requirements. They can help you plan for and manage your wealth by offering services like estate planning, planning for charities, and tax guidance. CPWAs, CFPs, CFAs, and individuals that are registered with your state or the SEC can be wealth advisors.

- Tax advisor: If you only need help with your taxes, tax advisors specialize in this area. You can get tax planning and preparation services from a CPA, a PFS, or an EA, among other certified professionals.

- Retirement advisor: Retirement advisors help you plan for retirement and can provide investment strategies to meet your goals. CFPs can be retirement advisors.

- Robo-advisor: A robo-advisor is technically a tool — it’s a digital platform that, similar to human financial advisors, offers advice and can invest on your behalf based on your financial goals. They cost less than hiring traditional financial advisors. Companies must register robo-advisors with the SEC.

How to Choose a Financial Advisor

To choose the most suitable financial advisor based on your needs, here’s a few recommended steps:

- Confirm if they’re registered with FINRA, SEC, or other regulatory bodies: You should ask about their certifications and licenses to ensure they are trained for the job. They should also be registered with the proper regulatory bodies.

- Discuss the advisor’s previous experiences: Learning about the financial advisor’s prior experiences and successes can help you identify if they can help you with your goals. Good financial advisors will strategize based on your values and priorities, and a relevant background can help with that.

- Ask whether they are fiduciary advisors: It’s better to opt for fiduciary advisors, as they are bound by law to put your interest first, and are required to reveal conflicts of interest.

- Understand their fee structure: Payment structures are a strong indicator of an advisor’s business model. Be cautious if an advisor’s primary compensation is commissions. Always ask about their specific fee model and how they are compensated for all services and products recommended. A fiduciary standard is inherent for advisors operating under a fee-only model (compensated solely by client fees). For fee-based advisors (who charge fees and may also earn commissions), inquire specifically about their fiduciary duty in all aspects of their advice. If an advisor offers ‘free’ advice, it often means they are compensated by selling you a product (like insurance), making transparency about their compensation even more vital.

Our Commitment to You

As an Investment Advisor, we focus on providing financial advice and wealth management services to help people pursue their financial goals. We have decades of professional experience. What’s more, as a fiduciary advisor, we have our clients’ best interests at heart, only providing recommendations that fit their specific situation.

Whether you’re looking to improve your personal finances, manage finances for your business, or plan for retirement, we can help with personalized services based on your needs and circumstances. Because we also believe in building trust with our clients, transparency is at the foundation of our business, so you won’t have to worry about hidden fees.

Ready to take the next step towards your financial goals? Use our matching tool today to connect with a financial advisor who understands your unique needs.