How to Become a Millionaire – Understanding Compounding Interest

Compounding interest is like a snowball rolling downhill. It starts small, but the more it rolls, the bigger and faster it gets. That’s the magic you can leverage to become a millionaire. Here’s how:

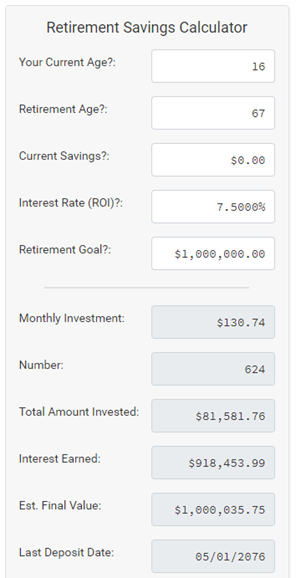

Let’s create a scenario where a 16-year-old starts saving just over $130 per month from his part-time job and puts it in a Roth IRA, for which there is no age threshold.

Save Consistently: Even small amounts can add up significantly over time. Our 16-year-old continues to do this throughout his entire working life.

Invest Wisely: Look for investment options with a good historical rate of return, like low-cost index funds. These offer diversification and generally track the market, reducing risk.

Tradethatswing.com reports that as of February 2024, the yearly average 30-year return of the S&P 500 is 10.22%. Assuming the dividends are reinvested and adjusted for inflation, the 30-year average stock market return is 7.5%.

Let it Ride: Avoid the temptation to withdraw your money unless absolutely necessary. Reinvest your earnings to keep the compounding cycle going strong. Remember that the market is not always on an upswing. There will be bull and bear markets to endure.

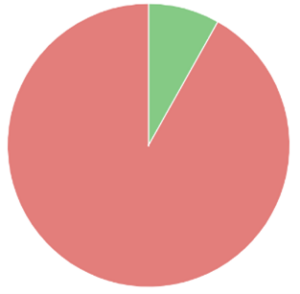

In our pretend scenario, our 16-year-old is consistent with his $130 monthly investment, and he averages 7.5% interest over his 50 years of working. He would have saved just over $80,000 of his income but earned over $900,000 in interest, making him a millionaire by the time he retires. In the pie chart shown, the green represents the total deposits while the red represents the interest. Compounding interest did the lion’s share of the work.

Here’s a Reality Check: Becoming a millionaire solely through consistent saving, compounding interest, and average market returns might take a long time, depending on your starting point and lifestyle. Additionally, one million dollars may not be enough to retire for many people, so while compounding interest is a powerful tool, it’s one piece of the puzzle. Our pretend sixteen-year-old can and should do more as he ages into more professional jobs and higher income.

For many people, hiring a financial advisor is a vital piece of the puzzle to ensure that you do not run out of money before you run out of breath. In a nutshell, a financial advisor acts as your personal financial coach, empowering you to make sound financial decisions and achieve your long-term financial goals.

When to Consider a Financial Advisor:

A financial advisor can be a valuable asset, especially when:

- Complexity Increases: As your financial situation gets more complex, with multiple investments or inheritance planning, a professional’s guidance can be crucial.

- You Need a Personalized Plan: They can tailor a strategy to your risk tolerance, financial goals, and timeline.

- Emotions Cloud Your Judgement: Making investment decisions during market downturns can be stressful. A financial advisor can provide objective advice.

- Wealth Accumulates: For many people, once they start to nearly half a million of investable assets, it becomes wise to talk with a professional. There are many reasons for this, like possible opportunity loss. Opportunity loss, also known as opportunity cost, is the potential benefit you miss out on when you choose one financial decision over another. The more money you have saved, the more potential harm a bad decision can cause.

What does a financial advisor do?

-

Holistic Financial Planning:

- Understanding Your Needs: Advisors analyze your complete financial situation, including income, debts, assets, spending habits, and future goals.

- Creating a Roadmap: They design a customized financial plan that outlines strategies for saving, budgeting, investing, debt management, retirement planning, tax optimization, and other crucial aspects tailored to your individual circumstances.

-

Expertise with Investing:

- Building your Portfolio: Advisors help you pick investments that align with your risk tolerance and financial objectives. They diversify investments to minimize risk and aim for long-term growth potential.

- Ongoing Management: They monitor your investments, rebalancing your portfolio as needed to maintain your desired risk profile and adjust it based on market changes or shifts in your life goals.

- Tax Strategies: They help minimize your tax burden by employing strategies like tax-efficient investments and tax-loss harvesting.

-

Support and Guidance:

- Navigating Complexities: They break down complex financial jargon and concepts into easy-to-understand explanations.

- Objective Advice: Fiduciary advisors offer unbiased recommendations, keeping your best interests at heart and helping you avoid emotionally driven investment mistakes.

- Goal Accountability: They track your progress, reminding you of your long-term goals and keeping you motivated throughout your financial journey.

-

Coordinating Other Advisory Services:

- Estate Planning: Advisors can assist in preparing wills, trusts, and other estate planning strategies to protect your assets and ensure smooth wealth transfer.

- Insurance Planning: They recommend insurance solutions to manage risks related to life, health, or disability.

- Access to Other Professionals: Advisors can connect you with other trusted experts, such as tax professionals or attorneys, for more specific needs.

Remember: There’s no one-size-fits-all approach. Building wealth is a marathon, not a sprint. Starting early, being consistent, and making smart choices will put you on the path to financial freedom and potentially millionaire status.

Fort Pitt Capital Group, LLC is an investment advisor registered with the United States Securities and Exchange Commission (“SEC”). For a detailed discussion of Fort Pitt and its services and fees, see the firm’s Form ADV Part 1 and 2A on file with the SEC at www.adviserinfo.sec.gov. Registration with the SEC does not imply any particular level of skill or training.

Investing involves risk. Principal loss is possible.

The S&P 500 is a broad-based index of 500 stocks, which is widely recognized as representative of the equity market in general. The index is unmanaged and may represent a more diversified list of securities than those recommended by Fort Pitt. Fort Pitt may invest in securities outside of those represented in the index. The performance of an index assumes no taxes, transaction costs, management fees or other expenses. Additional information on any index is available upon request.