Will College Costs Wreck Your Retirement?

New mother and Fort Pitt Capital Group Financial Advisor Emily P. Franco, CFP®, discuss frequently asked client questions about 529 and other college savings plans with Lead Advisor and father of two college students, Brad Newman. They cover topics like:

- Where, when, and how to start saving for college

- Establishing a goal for college funding & evaluating how realistic that goal is

- Balancing saving for retirement and saving for your child’s education

- 529 plans and beyond: what is the best vehicle for saving for college?

- And more!

Want Brad and Emily to answer your

college savings questions? Contact them today!

Basics of a College Savings 529 Plan:

Contributions

- Under federal law, contributions cannot exceed anticipated cost of education.

- 529s are administered by states, so states often place limits on total contributions.

- 529 contributions are still subject to gift tax rules:

- The annual gift tax exclusion is $15,000 per taxpayer per year.

- A one-time lump sum of $75,000 to a 529 is allowed if the taxpayer does not make more contributions for 5 years.

Distributions

- 529 funds can be used for qualified education expenses tax-free.

- Tuition/Fees

- Room and Board

- Textbooks

- Peripheral Equipment

- You can take scholarship amounts penalty-free (still owe income tax).

- If your child decides not to go to college, the funds can be transferred to qualified family members tax-free.

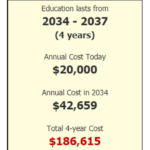

College Savings Scenario

- Steve and Linda want to help their son, Rich, who is 5 years old and will attend college in 13 years, pay for his college education.

- Steve and Linda want to give him $20,000 per year in today’s money.

- They expect college costs to increase by about 6% per year and anticipate a 5.25% return on any invested assets.

- They want to put away money each month to fully fund the expense.

What will college cost?

- The costs of Rich’s education are outlined to the right.

- As can be seen, the projected cost at 6% inflation is more than twice the cost today.

- In Rich’s final year of college, Steve and Linda will be paying over $50,000.

How much to save for college:

- The chart at right describes how much Steve and Linda must save to fund the cost.

- Assuming a 5.25% interest rate on the investment, they must invest $761/month for the next 13 years.

This equates to an annual amount of over $9,000/year