Savvy Social Security Planning: Basic Rules and Claiming Strategies With Beth Lynch

Beth Lynch, CFP® Financial Advisor at Fort Pitt Capital Group covers social security planning basic rules and common questions.

Basic Rules:

- Rule #1: Monthly Benefits Rise With Claiming Age

- Rule #2: Your Spouse May Be Able to Claim Benefits on Your Earnings Record

- Rule #3: A Divorced Person May Be Able to Receive Spousal Benefits Based on an Ex-Spouse’s Work Record

- Rule #4: Widows And Widowers May Receive Survivor Benefits

- Rule #5: If You Claim Benefits Before FRA And Work, Your Benefits Will Be Withheld

- Rule #6: Your Benefits May Be Subject to Tax

Common Questions:

- What Is Primary Insurance Amount (PIA)?

- What Is Full Retirement Age (FRA)?

- What Happens If You Apply for Social Security Early?

- What Happens If You Apply for Social Security After Full Retirement Age?

- When Should You Apply for Social Security?

- How to Estimate Your Social Security Benefits

- What Are the Rules for Spousal Benefits?

- What If Spouse’s Own Social Security Benefit Is Higher?

- What Are the Rules for Divorced-Spouse Benefits?

- What Are the Eligibility Requirements for Survivor Benefits?

- How to Maximize Survivor Benefits

- What Is the Annual Earnings Test?

- Are Social Security Benefits Taxed?

*Content is provided for educational purposes only.

Talk With an Advisor

Introduction

Introduction

Welcome everyone and thank you for joining us this afternoon. My name is Beth Lynch and I am one of the financial advisors here at Fort Pitt Capital Group. We have many clients that are joining us for this webinar, however, we do have quite a bit of individuals that may not be familiar with Fort Pitt Capital. Welcome to all of you.

About Fort Pitt Capital Group

A little bit about Fort Pitt is on the screen. We pride ourselves on bringing timely information to our clients, whether through our webinars, newsletters, or even our blogs. We help clients organize their financial lives by keeping them from making mistakes with their money and managing their portfolios so that they can achieve their goals.

About Beth

For those who don’t know me, here’s a little bit of information about myself. I have been in the financial field for over 26 years now, and I’ve recently gone through an intense social security training program that was over a few days. I’ve always talked to clients about social security and strategies, but I learned quite a bit through this training that I wanted to share with others. I thought it was so important that we provide this information to not only our clients but our community.

About Our Webinars

We are a resource not just for our clients but also for our community. There are many life questions that require us to work hand in hand with other professionals, whether it’s your attorneys, health care professions, or your CPA, for example. We know that complex issues can be hard to navigate. Our goal is for these webinars is not just to educate you, but to offer a way for the community to hear from financial advisors and other professionals all working together to get you on the right path.

With that said, today we’re going to talk about social security planning. In this presentation, we’ll be focusing on basic roles and strategies so you can find out what you need to know. But because social security planning is so individualized, you may have questions about your personal situation.

We welcome you to submit your questions in the chat. We should have time to get through some of them at the end. However, we have a lot of information in here that we want to get to so we are going to hold those to the end. If I do not get to those questions, we will put those together and get answers to those and get those sent out to all attendees.

Also, myself and the other advisors here at Fort Pitt Capital would welcome to meet with you at another time and discuss the roles and strategies that we’re talking about today. Feel free to reach out to me or your advisor if you have an advisor here at Fort Pitt Capital, and schedule some time with them.

If you have another advisor outside of Fort Pitt, make sure you’re bringing up this information this is crucial information to your financial future. In the meantime, I hope to acquaint you with some of the basic roles and strategies for social security claiming.

Basic Rule #1: Monthly Benefits Rise With Claiming Age

The first and most important thing to understand is that monthly benefits rise with claiming age. In other words, the longer you wait to file social security, the higher your benefit will be.

Many individuals feel the need to claim as soon as possible. I want to get my benefits. I want to start claiming. I want that income now just in case it’s not there. What if I don’t live long enough. We’re going to show you that that might not be in your best interest. To illustrate that, we need to go over a few things as far as some definitions and get some basics down.

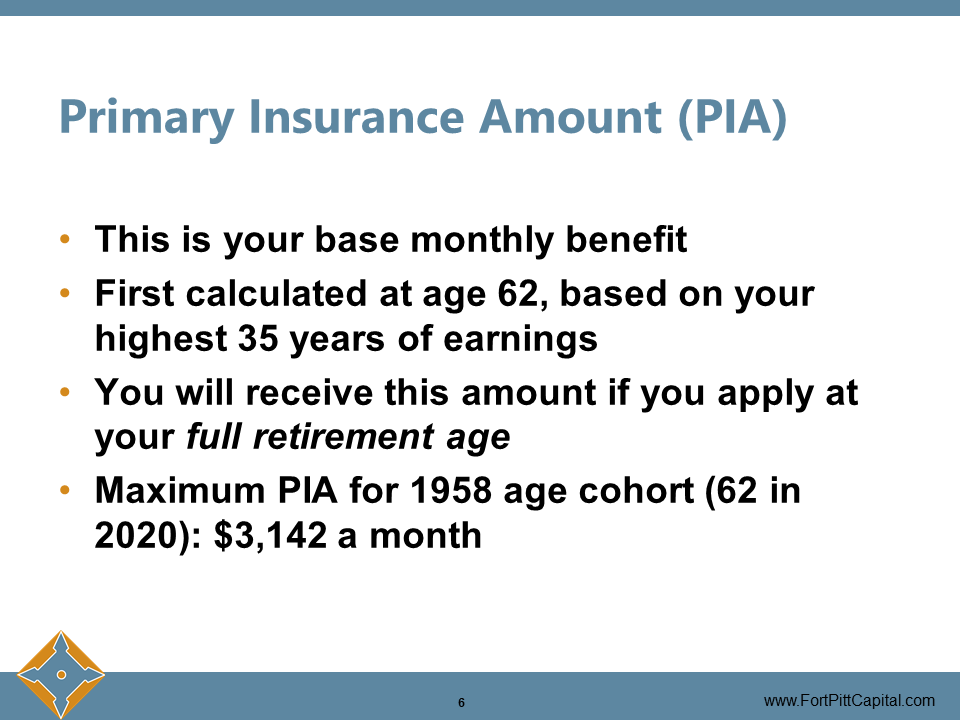

Primary Insurance Amount (PIA)

The primary insurance amount is your base benefit amount. If any of you have looked at your social security statement, the very top corner of your statement’s front page shows your benefit amount and that is your primary insurance amount or PIA.

This base amount is calculated at age 62, and it’s based on your highest 35 years of earnings. It’s the amount you will receive if you file for social security at your full retirement age, which I’ll talk about next.

During this presentation, we will not go into how to calculate PIA. It’s very, very complicated, but it’s important to know that it is based on your earnings history. If you’ve earned social security the maximum social security every year for 35 years, you would qualify for the max PIA. For 2020 is $3,142 a month.

If you worked less than 35 years or if you had several years of low earnings. You may still have an opportunity to increase your social security benefit. You can do that either by working longer or earning more money. As your income goes up, you’re replacing some of those lower-earning years with higher earnings.

But really our focus today is on claiming and claiming age so let’s keep on moving.

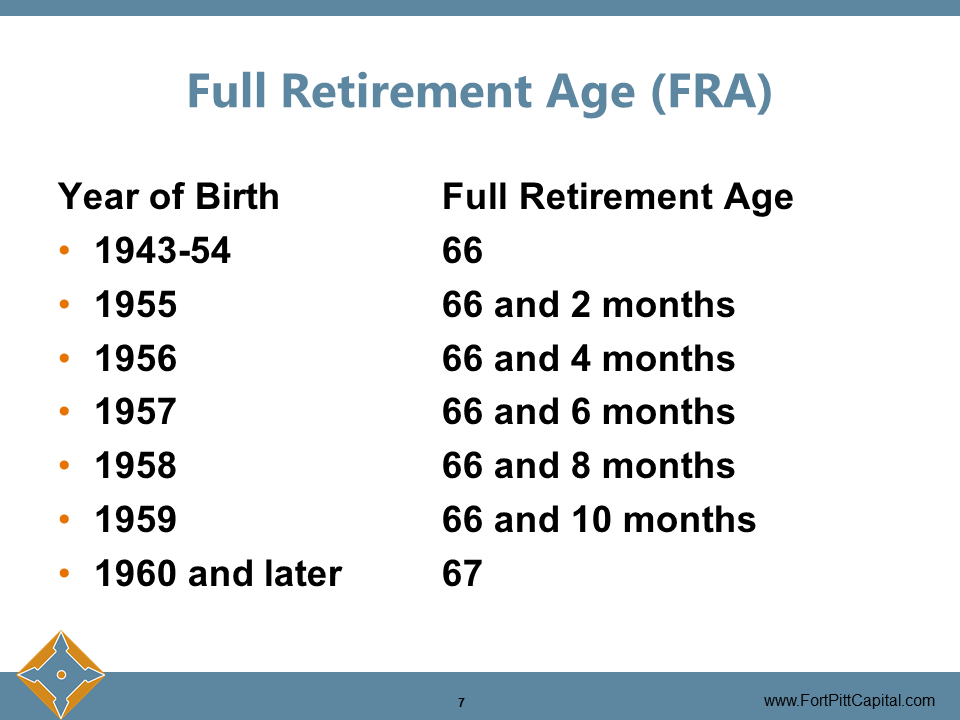

Full Retirement Age (FRA)

Another definition that we need to understand is what full retirement age is. This is not necessarily the age you plan to retire. Rather it’s the age in which you can claim full unreduced social security benefits.

This used to be 65 for everyone. It’s just common, it was actually lined up with your medicare, which we’re not going to talk about here. But that’s where that’s 65. Everyone used to be able to claim full retirement at 65. Now a higher benefit age is used and has been phased in since the 1983 amendment to social security.

So for everyone born between 1943 and 1954, your full retirement age is now 66. For everyone born 1960 and later, your full retirement age is 67. For those that were born between 1955 and 1959, your full retirement age is 66 plus some number of months depending on the year. So if you’re in that range of 1955 to 1959, maybe take a mental note of your full retirement age. Again this is all on your statement so if you have a current social security statement, you will see what your months are.

Full retirement age is the age at which you can claim full unreduced social security benefits. On an earlier slide, we saw that the maximum earner who turned 62 in 2020 will have that PIA of $3,142 a month. This is the amount that they will receive if they file for social security at full retirement age. So even though it’s calculated based on age 62, it assumes that you’re gonna still continue to work until full retirement age.

So claiming social security before full retirement age will cause your benefits to be reduced. Your benefit will be less than your PIA, and this is called the actuarial reduction. On the other side, claiming social security after full retirement age will cause your benefits to be higher than your PIA because you’ll earn what we call delayed retirement credits.

The important thing to remember and understand about reductions in credits is that they have been carefully worked out by social security. The actuaries have figured this out. Whether you fall at 62 or 70 or any age in between, they are used to dealing with many individuals. They know that some are going to die early, and some are going to live longer. They figured out exactly how to claim and the percentages and how people file and where the reductions in credits they’re going to get.

It’s very important for individuals to figure out what age you’re gonna file. The reason is, the age you file is going to determine your permanent monthly benefit. If you live longer than average or there’s even a chance you might live longer than average, you’ll be better off filing later and collecting a higher benefit for life, even if this means waiting a few more years for those checks to start.

What Happens If You Apply for Social Security Early?

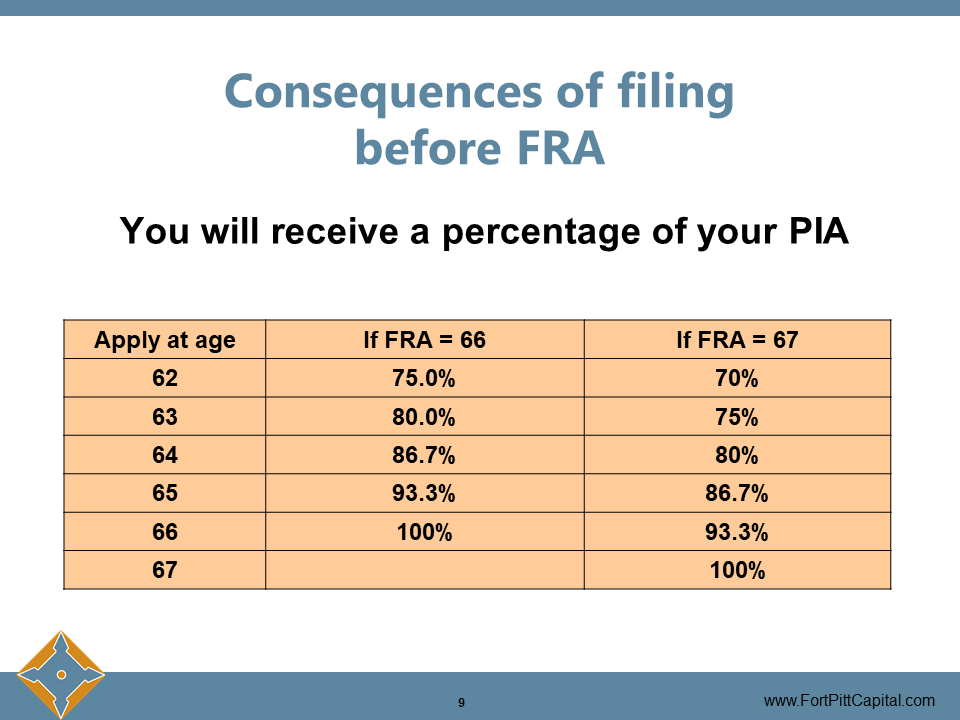

Your benefit will be reduced. You’ll receive a percentage of that PIA, depending on when you apply. If your full retirement age is 66 and you apply at age 62, you’ll receive 75 percent of your PIA benefit. At 63 it’s 80 percent of your benefit and so on down the chart. However, if your full retirement age is 67, again, actuaries have figured this out, and you apply at 62, you’ll receive 70 percent of your PIA. These amounts are actually prorated monthly so if you decide to apply any time after age 62 your benefit will be reduced by the appropriate amount.

What Happens If You Apply for Social Security After Full Retirement Age?

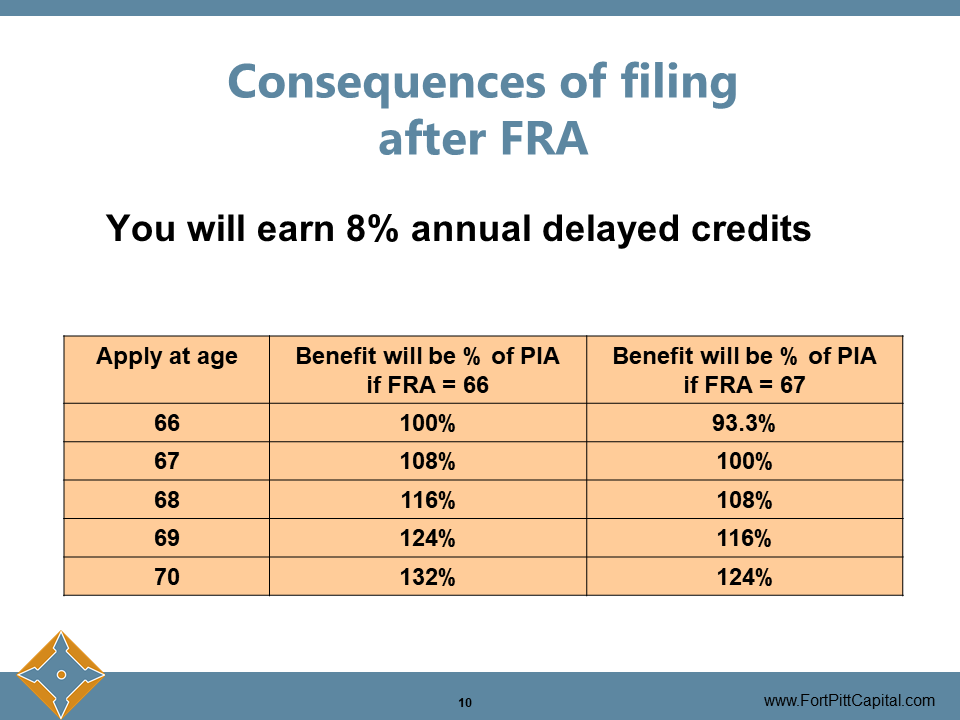

If you apply for social security after full retirement age, you will earn those delayed credits of 8 percent for each year you delay.

If your full retirement age is 66 and you apply at 67 your benefit will be 108 percent of your primary insurance amount, at 68 it’ll be 116 percent, and so on. However, after age 70 you cannot earn any additional delayed credits. That’s why we say it doesn’t pay to wait until after age 70 to apply for social security.

Cost-of-Living Adjustments (COLAs)

So now I mentioned that the age at which you claim social security determines your permanent monthly benefit. However, in any year that there’s inflation, your benefits get what’s called a cost of living adjustment or a COLA.

In 2020, the cost of living adjustment was 1.6%, so if you were receiving social security, you got a pay raise in 2020 of 1.6% on your benefits. Historically, the COLAs have varied very widely. There have been some years where there was zero, and in other years they were higher than 2%. Social security has projected that the COLA over the next 75 years is going to average about 2.6%.

Now the COLA is applied to the benefit amount. The higher the benefit, the higher your COLA will be, and it applies to the benefits you haven’t claimed yet.

Once your PIA is calculated at age 62 that will rise also each year with the cost of living adjustment even if you delay claiming to age 70. The upshot here is that between delayed credits and cost of living adjustments, the advantage of delaying claiming is even greater than most people realize.

When Should You Apply for Social Security?

The big question, the when to apply. It’s very complex, and it really does require customized analysis.

Here are a few points to remember:

- If you apply early, your benefits start out at some fraction of your PIA, whether it was 75% or 80%. We showed you that chart and it remains at that percentage for the rest of your life. It does not go up to 100% when you reach full retirement age once you claim that’s set.

- The COLAs will magnify the impact of the early or delayed credit because the annual cost of living adjustment is applied to either the lower or higher amount, and this is what causes the disparity to increase with each passing year.

- The when to apply question impacts survivor benefits as well. If the higher-earning spouse maximizes their benefit by delaying until age 70, the higher benefit will transfer over to the lower earnings spouse at death. We’ll cover this within the survivor benefits section in a few minutes.

- Of course, you’ll need to take into account your health status, life expectancy, income needs, and your overall retirement plan when deciding when to claim social security. A lot of people always say that I don’t know how I can continue to earn and receive a paycheck if you will if I don’t claim social security early. Again that’s what we help you do by putting together your plan and seeing what other baskets you have available to see if they’d be sustainable so you can hold off on claiming if it makes sense for you.

How to Estimate Your Social Security Benefits

There are a couple of ways you can do this.

- One, you can refer to your statement. It’s also a great way to check and double-check your earnings history.

- You can go to the website, and you can use the calculators to estimate your retirement benefits. You’ll need to set up an account and answer some of those questions. They usually ask you for your date of birth, your social security number, and your mother’s maiden name. Don’t worry that the site is secure, so it’s easy to do. They also have a few other calculators on there that you can use to estimate.

- You can give us a call, and we can help you figure out exactly how to estimate your benefits going forward. The website’s there for you guys to use to log on if you have not set up your account on social security.

Basic Rule #2: Your Spouse May Be Able to Claim Benefits Based on Your Earning Record

Before we discuss spousal rules, I’d like to make one quick clarification.

As you may remember, way back in 1939 spousal benefits were created to give non-working spouses, usually wives, a small benefit based on their husband’s work record. But social security is a gender-neutral program. Husbands may be able to claim spousal benefits also. Now that same-sex marriage is legal in all states. Either spouse, regardless of gender, may be able to claim a spousal benefit. So there you go. Sometimes it does pay to be married.

More importantly, in the age of these two-income families, spousal benefits may be paid even if both spouses work, so there are some exceptions there.

Rules for Spousal Benefits

Here are the rules for spousal benefits:

- The spousal benefit is equal to 50 percent of the worker’s primary insurance amount if the spouse applies for it at full retirement age.

- The primary worker must have filed for benefits. Let’s use Jack and Jill here as an example. In order for Jill to claim a spousal benefit on Jack’s work record, Jack must first file for his own social security benefits. This rule comes into play when we talk about claiming strategies, and it can trip up a lot of people if you’re not careful.

- A spouse also must be at least 62 to file for that spousal benefit. If the spouse claims the spousal benefit at 62, that benefit will be reduced for the life of the receiving benefit.

- Spousal benefits do not earn delayed credits after age 66 or actually full retirement age. The most the spouse can ever get is 50% of the other spouse’s PIA. Again, I keep stressing spousal benefits because a lot of people get spousal benefits and survivor benefits mixed up. Remember, these are spousal benefits and not survivor benefits. We’ll talk about survivor benefits shortly.

- For the most part, you can get a spousal benefit if it’s greater than the benefit available on your own record. If 50% of your spouse’s PIA is higher than your own PIA then you can receive a spousal payment. There is an exception here, but it’s kind of complicated, and we’ll circle back to that in a few minutes.

Example Calculation of Spousal Benefits

An example here of calculating Jack and Jill.

So for the spousal benefit, as I said, it’s 50% of the worker’s PIA. If Jill applies for her benefits at her full retirement age and Jack’s PIA is $2,000 and Jill’s is currently $800, when she applies at her full retirement age her benefit will be equal to 50% of Jack’s PIA or $1,000 as opposed to her $800. This is $200 more and benefits her based on her own work record.

It does pay to wait for that full retirement age to get that up.

What If Spouse’s Own Social Security Benefit Is Higher?

But what if Jill has more than half of the spouse’s PIA? In this case, she will not receive a spousal benefit. She would be paid on her own benefit instead. I know there was a question that had been submitted about who can claim, and this is one of those cases where you cannot claim on your spouse if your benefit is more than 50% of your spouse.

There is an exception to this. I will note that, but it doesn’t apply to everyone. In this example, Joe’s PIA is $1,500 a month. Since her benefit amount is higher than 50% ofJack’s benefit, Jill will just receive her benefit and will not get a spousal benefit.

Spousal Benefit Exception Rule

Here’s the exception. If Jill in our example was 62 or older at the end of 2015, she may file what’s called a restricted app for Jack’s spousal benefits and receive 50% of his PIA while her own benefit builds those delayed credits to age 70. If you were born before January 1, 1954, you may be able to take advantage of this. This strategy can give a couple tens of thousands of dollars in extra spousal benefits and was considered a loophole, and that’s why it was closed by the budget act of 2015.

But new rules are being phased in. People who, as I said were born January 1, 1954, or earlier are grandfathered in under these old rules. Again, if you’re eligible, we definitely encourage you to take a look at that and see how it could work for you. I’ll be showing you an example here.

Example: Social Security Spousal Planning – Maximization Strategy

Regardless of which rule you fall under, the key is to maximize benefits for a married couple. The way to do that is to coordinate those benefits.

Here’s what we found.

When both spouses have relatively high PIAs, that is, the lower-earning spouse’s primary insurance amount is more than half of the higher-earning spouse’s PIA, it pays for both spouses to claim their respective benefits at age 70 to get the maximum delayed credit.

Our calculators show that if both spouses have average or longer than average life expectancies, this will maximize the benefit for both of them over their lifetime. Of course, we know that health and longevity, and other investments are all going to come into play and should be taken into consideration when building out your strategy.

Then depending on the spouse’s ages, one spouse may be able to claim a spousal benefit between age 66 and 70, but this is the exemption I mentioned earlier. If you were born before January 1, 1954, you may be able to claim a spousal benefit at age 66 while your benefit builds those delayed credits.

Please come talk to us so we can determine if you are grandfathered under the rules. If so, it can mean tens of thousands of dollars and we can show you how to apply for that restricted app. Again this is only for a select few individuals.

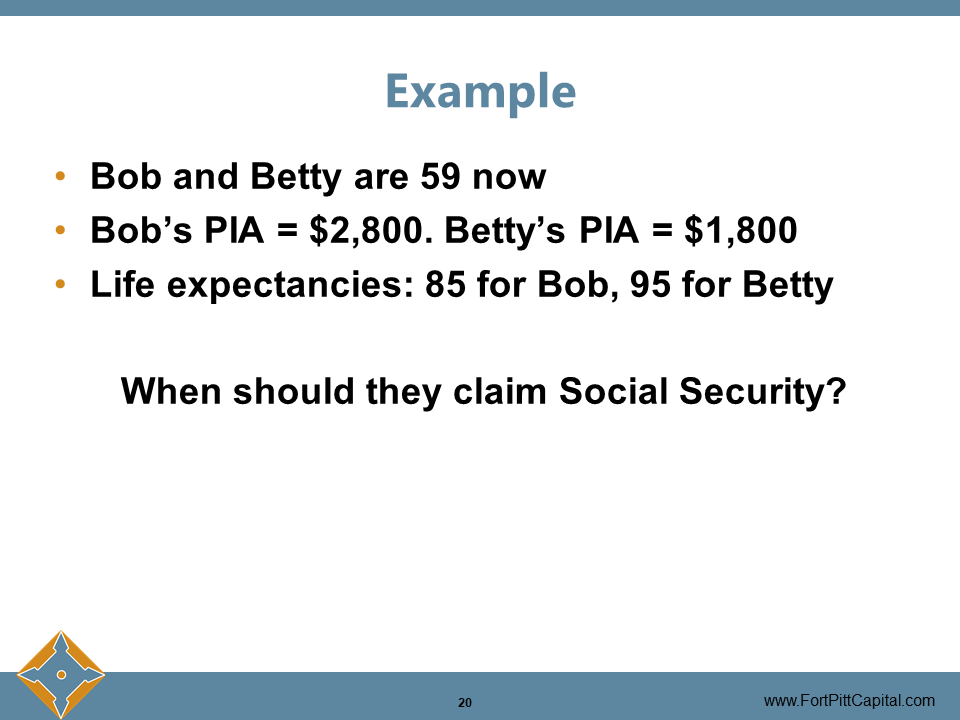

Example

Let’s take a look at an example with Bob and Betty, who are married. They’re currently both age 59 and Bob’s PIA is $2,800 and Betty’s is $1,800. Let’s assume that their life expectancy is 85 for Bob and 95 for Betty. Sorry, we always seem to kill off the men first.

So the question is, when should they claim social security.

I’m going to show you what our analysis puts together in our calculators. This is just a partial analysis that we can run for our clients and give them as a handout when we’re building portfolios and plans for our clients.

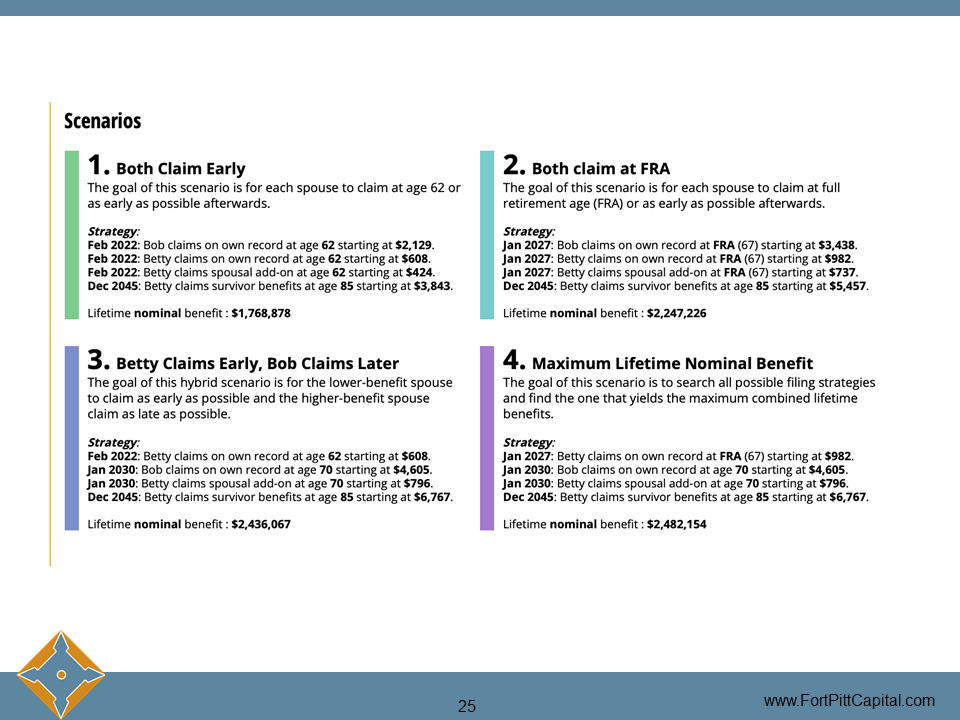

This calculator is going to identify several different claiming scenarios and strategies for Bob and Betty.

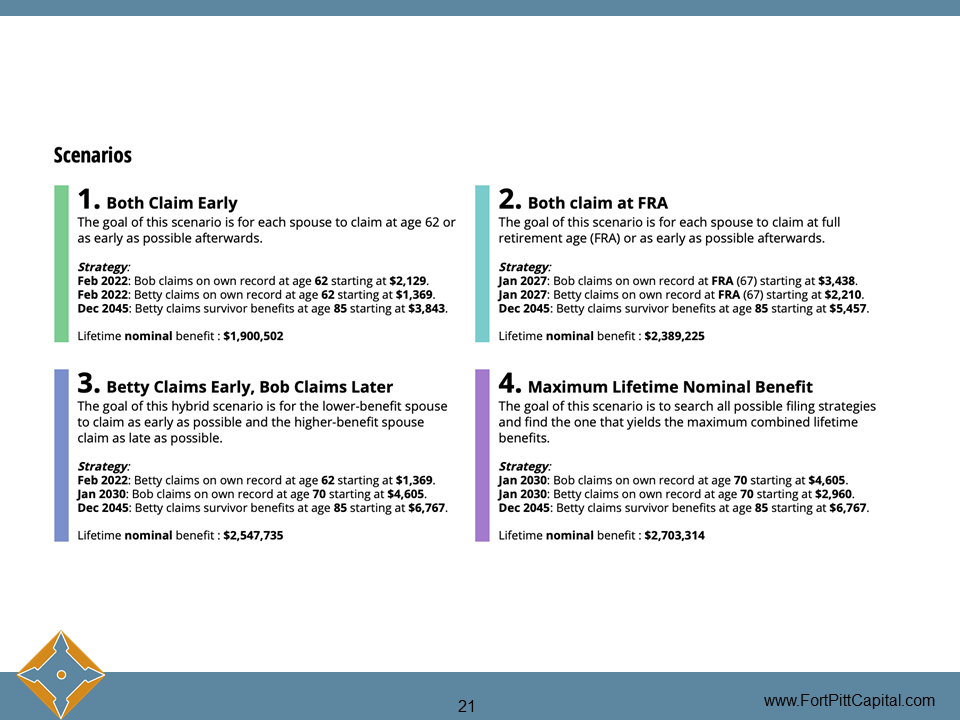

Scenario 1: Both Claim Early

Scenario 2: Both Claim at Full Retirement Age

Scenario 3: Betty Claims Early, Bob Claims Later

Scenario 4: Maximum Lifetime Nominal Benefit

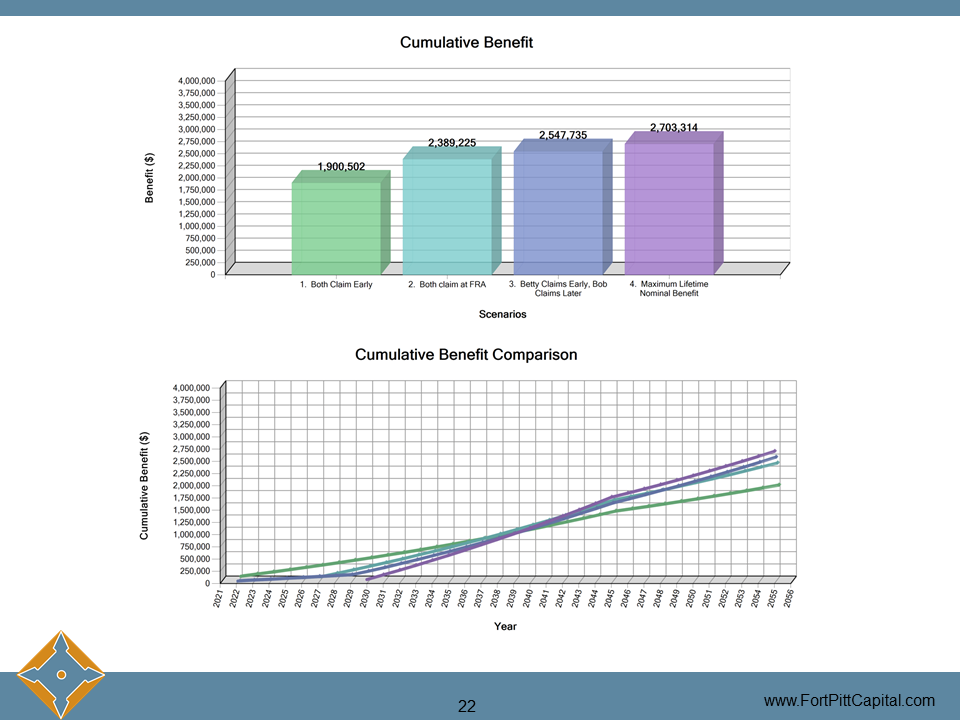

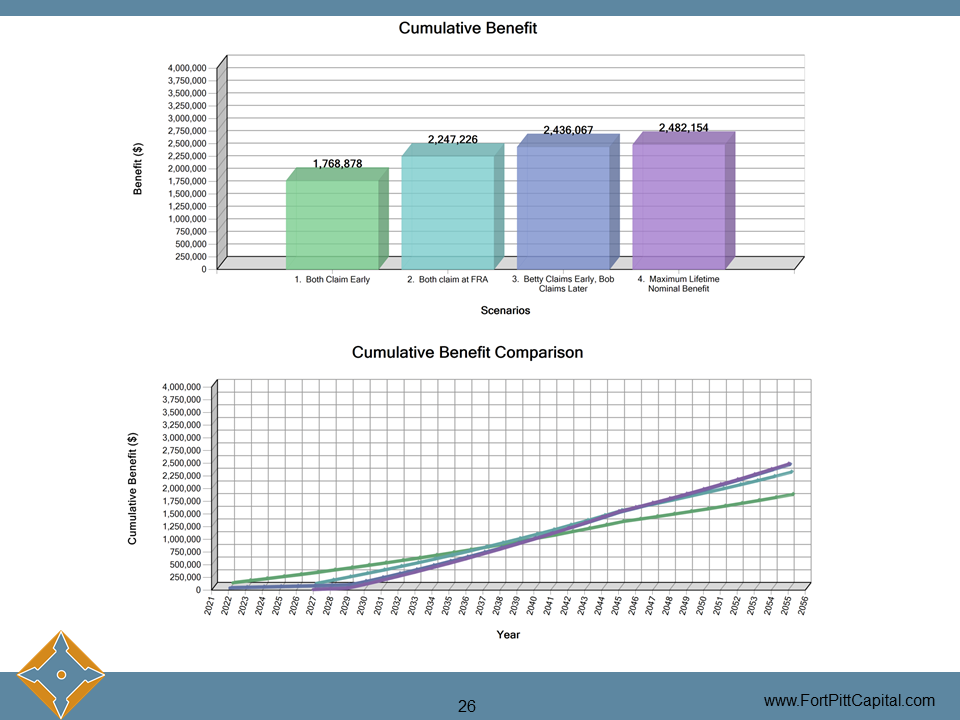

Here’s the graph that shows those lifetime benefits for each claiming scenario.

It’s hard to believe that a couple could easily receive over $2,000,000 in social security benefits over their lifetime. That’s what can happen if you resist the urge to claim benefits at 62.

You can see here that they will get the most lifetime benefit if each claims benefits at age 70. Sometimes it’s not always possible, but if you’re able to, it makes a lot of sense going forward. Now you can see that in this scenario, because of Betty’s PIA she wasn’t entitled to a spousal benefit because of her benefit is higher.

Example: Continued

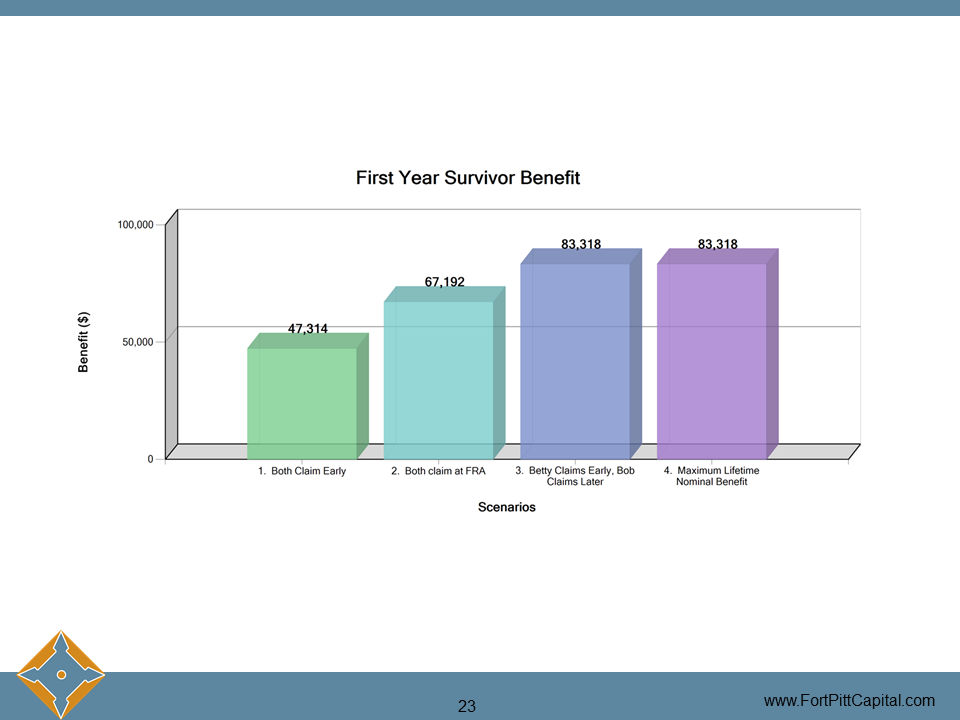

But let’s say Bob passes away at age 85. Betty will now be entitled to a survivor benefit. This chart shows the first-year survivor benefit for the longer-lived spouse, in this case, Betty.

When Bob dies at age 85, she will step into his benefit and her survivor benefit. Her benefit will then stop. Remember, when one spouse dies, you’re losing one of those incomes. You’ll go down to claiming only one benefit. Some individuals think they’re going to get two benefits, survivor and their own, but this is not the case.

So you can see here that the two scenarios that call for Bob to claim at age 70 will give her the highest survivor benefit.

Example Continued

So let’s say now we change Betty’s PIA to $800 dollars, which is less than half of Bob’s PIA. Now she’s entitled to a spousal benefit and we refer to this a lot of times as called a spousal add-on benefit.

Scenarios

Scenario 1: Both Claim Early

Scenario 2: Both Claim at Full Retirement Age

Scenario 3: Betty Claims Early, Bob Claims Later

Scenario 4: Maximum Lifetime Nominal Benefit

So her benefit is actually a combination of her own benefit and a spousal add-on. This gives her a total benefit of $1,400, which is half of Bob’s PIA.

Because spousal benefits don’t build delayed credits, Betty will max out her benefit by claiming at full retirement age. She won’t get any more by waiting until age 70.

Example Continued

This graph looks similar to the first example, but the total amounts are a bit lower because of Betty’s PIA being lower.

You can see that by looking at the claiming strategies, which one provides the most lifetime benefits. You can also see how close they are.

For example, Scenario 3, where Betty claims her benefit at age 62 is very close to Scenario 4 where she waits five more years and claims at full retirement age. She might want to go ahead and start her benefit at age 62. These are the things that we would look at for you to determine if this makes sense.

The important thing is for the higher-earning spouse to hold off as long as possible and possibly age 70. Because this is what really maxes out the higher benefit for Bob while he’s alive and allows Betty to claim that benefit after he passes to give her a higher survivor benefit than him claiming early.

Total benefits will depend on life expectancy assumptions, here we used 85 and 95, but we can always change that to illustrate different ages.

I know a few of you are thinking if I retire where will my income come from if I hold off on claiming social security.

I’ve said it a few times here, but that’s part of what we do for our clients. We’re making sure we have a plan for every client to demonstrate the effects of these claiming strategies at different ages and at different life expectancies. We take a look at your total portfolio to see if it makes sense to make withdrawals from your investments while earning those delayed credits. Or if it makes more sense to take social security at full retirement or earlier based on your portfolio.

Basic Rule #3: A Divorce Person May Be Able to Receive Spousal Benefits Based on an Ex-Spouse’s Work Record

Divorced individuals may be able to get spousal benefits based on an ex-spouse’s record. We all probably know someone who’s divorced or is getting divorced, or maybe you’re the one that is divorced.

The rules for divorcees are pretty similar to those of married couples, but there are a few restrictions.

Rules for Divorced-Spouse Benefits

Let’s go through some of those rules:

- A person can receive social security based on an ex-spouse’s work record provided that the marriage lasted at least 10 years.

- The divorced person claiming the benefit is currently unmarried.

- The ex-spouse must be at least age 62.

- The divorce had to have occurred more than two years ago.

Notes: Divorced-Spouse Benefits

A few more things to note about divorced spouse benefits:

- More than one ex-spouse can receive benefits on the same worker’s record

- So if your ex-spouse has remarried a couple of times all three exes can claim on a divorced spouse benefits as long as those marriages lasted at least 10 years. I’ve had clients come up to me and say, oh well he’s remarried and I didn’t know that I could get that, I don’t want to mess their benefits up, it has nothing to do with the ex-spouses or the new marriage. The benefit is the same for all. I’m going to use the example of Johnny Carson.

- He was married four times. His marriage to Jody lasted 14 years, so over the 10. His second marriage to Joanne only lasted 9 years. His third marriage to Joanna lasted 13 years. His fourth marriage to Alexis lasted 18 years. If you look at all of those, Jody and Joanna could have each claimed a divorced spouse benefit on his record because of those marriages lasting more than 10 years, assuming they were not remarried. Now when he died in 1985, both Jody and Joanna could claim divorced-spouse survivor benefit, and Alexis could claim a regular survivor benefit because she was still married to him when he passed. Now the second wife, Joanne, is out of luck again because that marriage only lasted nine years.

- The benefits that are paid to one ex-spouse are not going to affect the payments to the worker, the current spouse, or other ex-spouses. You don’t need to even know where your ex-spouses live currently. You just need enough identifying information that social security can help you look up his or her record.

- You also need to provide documentation showing the dates of the marriage and the divorce, they want to see that 10 years. Sometimes that’s the hardest part is finding those documents.

- Please note, if you are receiving divorced spouse benefits and you remarry, your divorced spouse benefits will go away. However, you may be eligible to receive spousal benefits based on your new spouse’s work record. You can always switch to that or your own record if you also qualify for social security.

Basic Rule #4: Widows And Widowers May Receive Survivor Benefits

This is where it gets a little bit more complicated, which is the survivor benefits. We’ll try not to get too lost in the weeds but survivor benefit planning is essential and there are a few things that you absolutely need to know.

Eligibility for Survivor Benefits

In order for survivor spouse to receive a survivor benefit

- The marriage must have lasted at least nine months. Of course, there’s an exception if there’s an accident.

- To start the benefits, the survivor must be at least 60. There’s an exception if you’re disabled at age 50. However, if the widow or widower applies before full retirement age, the benefits will be reduced as it is for regular retirement benefits. When we’re looking at when to decide to apply for regular retirement benefits, you also want to think about when to apply for survivor benefits.

- If you remarry before age 60 you will not be able to receive a survivor benefit based on your previous spouse’s record unless that remarriage ends. We’ve seen cases where a survivor is contemplating getting remarried in their late 50s, and they have held off until they’ve turned 60. They had a nice long engagement in order to be able to claim those survivor benefits from their first spouse. If you remarry after age 50, you’ll still be able to claim those survivor benefits but sometimes it makes sense to hold off if possible.

- Divorce spouse survivor benefits are available if the marriage lasted at least 10 years, which we talked about in the divorce section.

- As we saw with Johnny Carson, two of his ex-spouses could claim divorce-spouse survivor benefits after his death because of those marriages lasting at least 10 years. Survivor benefits are twice as much as spousal benefits, and that’s why I was explaining and saying that there’s a difference between a survivor and a spousal benefit. The survivor benefit is 100% of the worker’s PIA instead of that 50%. That’s why we say holding off as long as possible is so important for that surviving spouse.

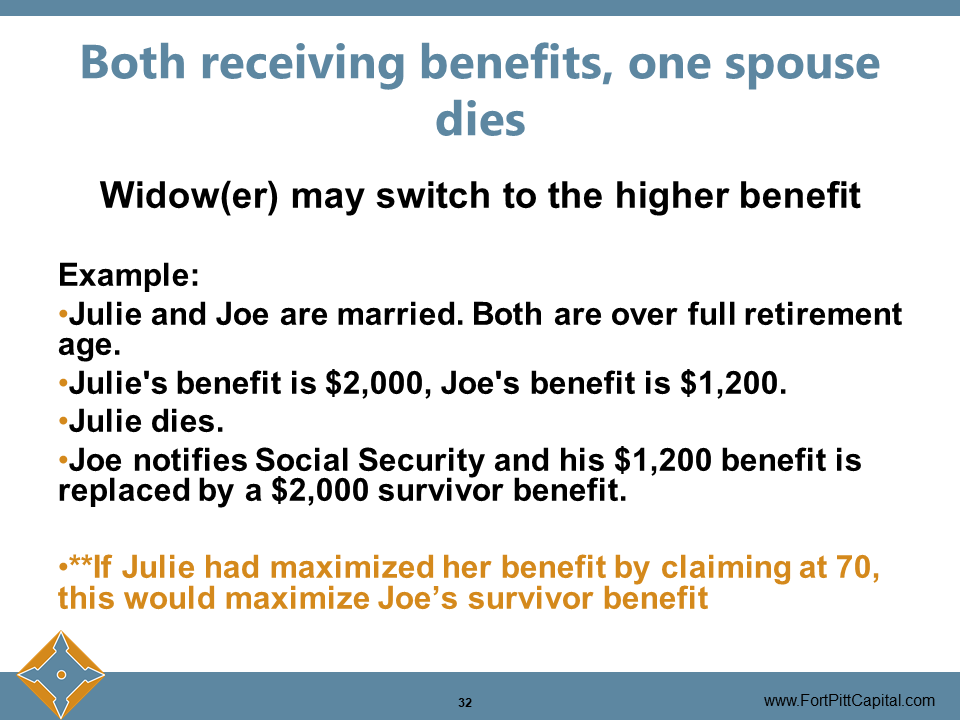

Example: Both Receiving Benefits & One Spouse Dies

Here’s an example.

Let’s say Joe and Julie are married. Both are over full retirement age and are currently receiving social security benefits. Julie’s benefit is $2,000 a month, and Joe’s benefit is $1,200 a month.

If Julie dies, Joe’s $1,200 benefit will stop and he will start to receive survivor benefit, which is equal to Julie’s benefit of $2,000 a month. One important note about survivor planning is at the loss of one benefit. Most widows and widowers need at least two-thirds of the amount of income they were receiving as a couple. It’s important to plan for the loss of one of those spouse’s social security benefits. Even if you plan out knowing that you can claim on the higher spouse’s benefit that’s what gives you those delayed credits and gives you that higher benefit going forward.

Often it’s the higher benefit that you want to retain at the death of a spouse, which you know when you’re losing one of your social security checks.

Also, Julie would have maximized her benefit by waiting, as I was saying about the delayed credits, and waited until age 70 to claim. Her benefit would be higher depending on what her full retirement age was. Let’s say that she got 32% and now her benefit was $2,640 with the additional delayed credits, Joe’s survivor benefit would be $2,640 instead of $2,000 dollars a month.

Again, maximizing his survivor benefit and giving him more than that he was receiving.

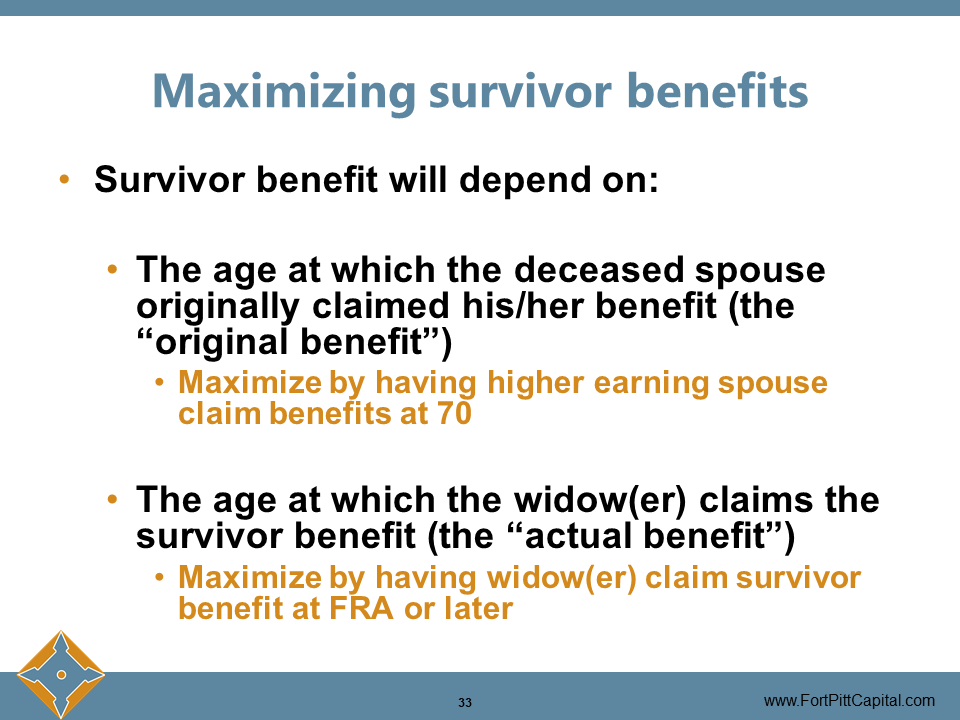

Maximizing Survivor Benefits

The main point that I want to get across is the amount of the survivor benefit is going to depend on two things:

- The age at which the deceased spouse originally claims their benefit. This is going to determine what the original benefit is.

- The age at which the widow or widower claims the survivor benefit to determine the actual benefit.

The widow or widower will receive the highest income if the deceased spouse originally claimed his or her benefit at age 70. The survivor claims the survivor benefit at full retirement age or later.

Higher earning spouses who feel young and healthy often don’t think about that survivor benefit when they’re deciding when to claim their own benefit. But, as we saw with some of the examples with Bob and Betty and Joe and Julie, the survivor income can be significantly lower if the higher-earning spouse claims their benefit early.

Survivor planning is a very important part of social security planning and especially for married couples. It can really influence the surviving spouse’s standard of living later in life based on the decisions you make now. It’s really a customized process. Everyone’s situation is different.

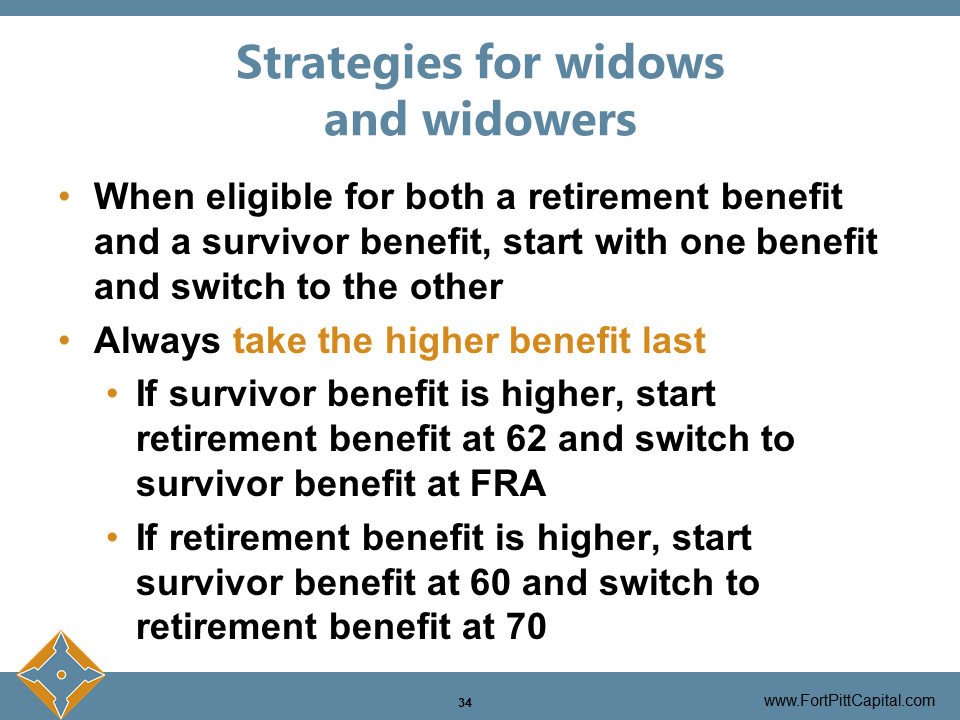

Social Security Strategies for Widows And Widowers

What if you already have been widowed.

Let’s say your spouse died either before or after starting social security benefits. Or maybe you were married over 10 years, divorced, and now your ex-spouse has passed away.

Is there anything you can do to coordinate your survivor benefit with your own retirement benefits to maximize income and lifetime benefits? Well, the answer is yes.

You can sequence your benefits to maximize your advantage. You can start with one benefit and then switch to the other.

The rule here is to always take the higher benefit last.

- If the survivor benefit is higher, then you start your retirement benefit and at age 62 and then switch to your survivor benefit at full retirement age.

- If your retirement benefit is higher, start your survivor benefit as early as age 60 and switch to your retirement benefit at age 70 by earning those delayed credits.

Let’s take a look at an example.

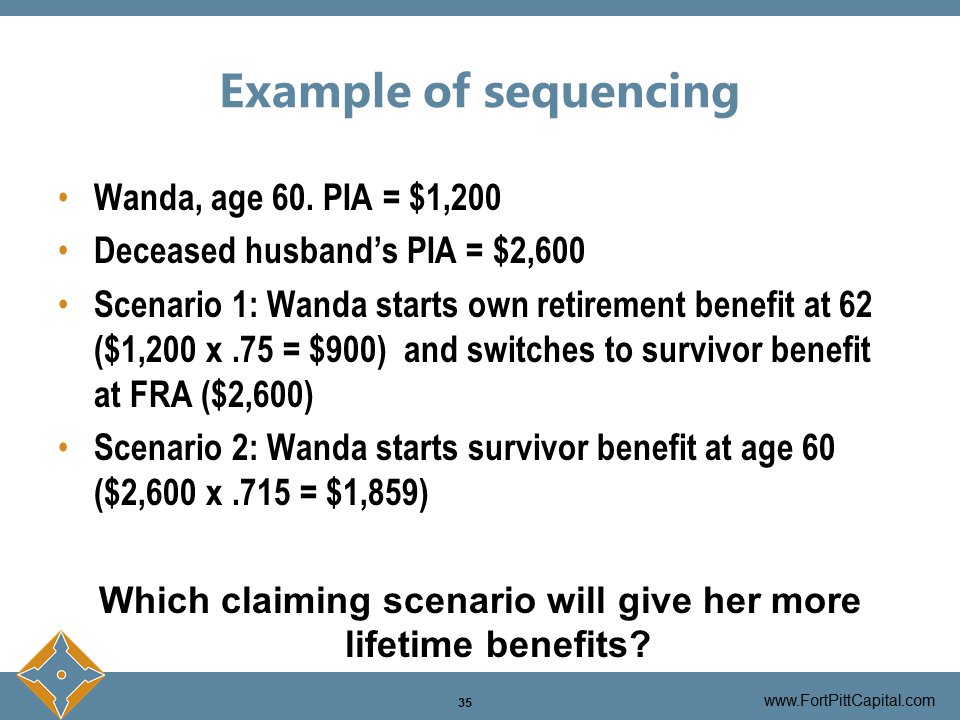

Example: Sequencing

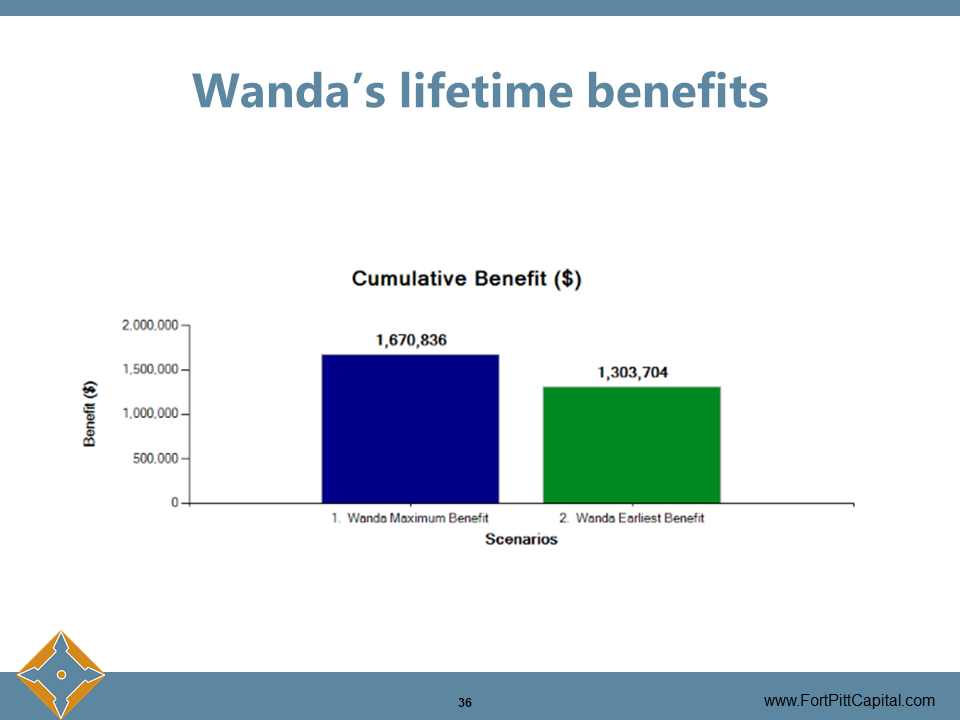

We’re going to look at widow Wanda. She’s 60 years old now so she’s able to claim survivor benefits. She has a PIA of $1,200, and her husband passed away before claiming his social security and his PIA was $2,600.

So there are two things Wanda can do:

- Scenario 1: She can resist the temptation to start her reduced survivor benefit at age 60 and hold out for the maximum by applying for it at age 66, which is her full retirement age. When she turns 62, she can start her own retirement benefit, and then when she turns 66 she can switch to the survivor benefit.

- Scenario 2: She can go ahead and start those survivor benefits now at age 60. This might be the natural choice because the survivor benefit is is higher, and she wants some income right away, but what you may not realize is that by claiming that survivor benefit now it will permanently be reduced for life. Instead of receiving $2,600 because of taking it early, Wanda would receive $1,859 a month.

Which one do you think will give her a higher benefit over her lifetime?

As you can see, there is over three hundred thousand dollars worth of differences over her lifetime. Wanda would receive more lifetime benefits if she can wait those two years and claim on her own benefit at age 62 and then switch to her maximum survivor benefit at 66

Again, survivor benefits aren’t going to earn those delayed credits, so that’s why you want to max out and start taking it right at full retirement age.

These claiming scenarios aren’t always intuitive and that’s why we really do depend on the calculators and the software that we use to show what the benefits would be over our lifetime, and base it on different claiming ages, different life expectancies, and seeing what each scenario can do and what makes sense for you.

Basic Rule #5: If You Claim Benefits Before FRA And Work, Your Benefits Will Be Withheld

We’ve already talked about the disadvantages of claiming early in terms of that reduction, but there’s also another reason why you may not want to claim early. That’s what’s called the earnings test.

If you claim benefits before full retirement age and you continue to work, your benefits will be withheld. This is what we refer to as the earnings test.

Annual Earnings Test

If you apply before you turn your full retirement age and you earn more than $18,240, that’s the earnings limit for 2020, every $1, and benefits will be withheld for every $2 you earn over $18,240. Again, $1 and benefits will be held for every $2 you earn. That’s over $18,240. That’s a low amount as far as income. You can see how someone can hit that very easily and actually not receive a benefit.

The other thing is, it’s important to know that you’re not really losing that money. Your benefit will be adjusted upward when you do turn full retirement age to make up for it. That’s as if you had applied for it later. This means if some of your benefits are withheld due to that earnings test, your new benefit will be higher. It’ll be recalculated as if you had started at age 63, 64, or 65 instead of 62 based on those earnings.

It can actually be advantageous in the event that you have filed, and you regret it. You know that if you are still working, you’re still earning credits and it does come back to you.

Don’t let the annual earnings test completely discourage you from working. The more money you earn, the more money you will have and benefits later on. As I said, they do not penalize you for working. They will adjust it and you will end up with a higher benefit for the rest of your life, assuming you continue to earn. Those will come back to you.

But the way to avoid the earnings test entirely is just waiting until your full retirement age, and then you don’t have to worry about calculating those reductions in benefits.

Little-Known Rules About the Earning Test

The other thing about the earnings test that people sometimes do not realize is that it applies to every type of benefit. It is for retirement benefits, spousal benefits, and survivor benefits. It may cause your spouse’s benefits to be withheld.

So, for example, if John and Jane are 62 and Jane’s getting that spousal benefit off of John’s record and John goes back to work, then Jane’s spousal benefit will be withheld depending on how much John makes.

Also, by the way, if you are self-employed or you’re a business owner who pays yourself a small salary to try to stay under or around the earnings test, you may be subject to some extra scrutiny. They are on to business owners that have done this.

You can skip the earnings test entirely if you just hold off until turning full retirement age. You will not have to worry about the earnings test. But it does come into play quite often, especially for survivor benefits because you want to take it at age 60, but if that survivor is still working, they realize that they end up not getting their survivor benefit, or it’s drastically reduced.

Basic Rule #6: Your Benefits May Be Subject to Tax

There’s a difference between a reduction in benefits based on earnings and taxation of social security.

Social security benefits may be subject to income tax, and the amount that you owe on your benefits is going to depend on how much other income you have. We’re not going to spend a ton of time here. There isn’t much really that can be done, but there are a few strategies you can deploy. It’s good to know what the provisional income is and what those taxes are for each tax filing status.

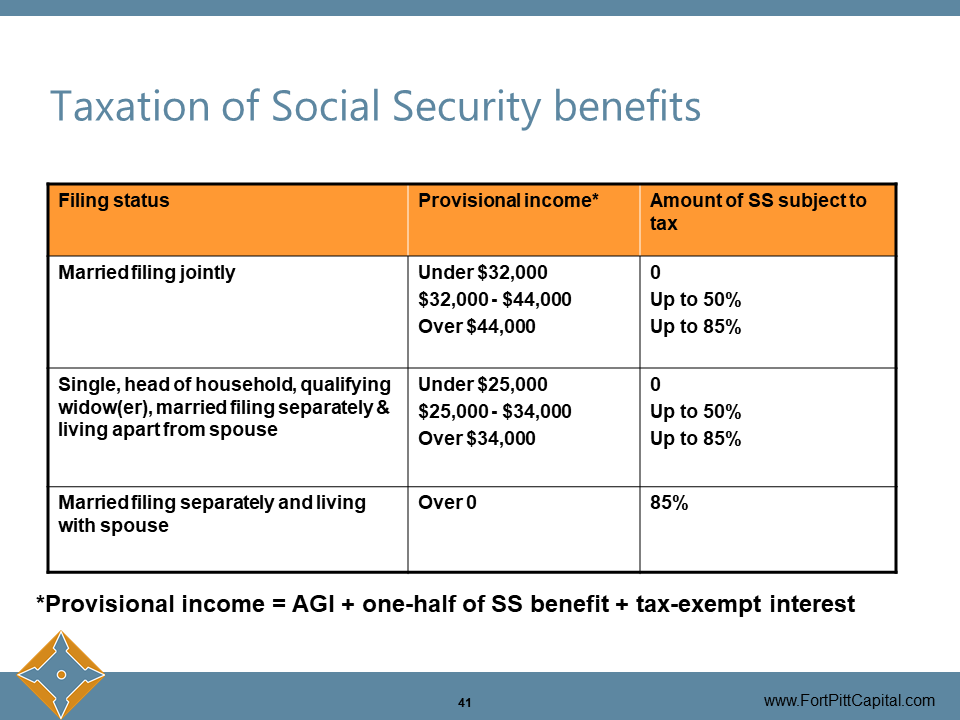

Taxation of Social Security Benefits

The table on the screen right now shows taxation of social security benefits based on different income levels and based on different filing statuses. Your income is not just AGI, it’s what’s called provisional income, and this includes your AGI plus one half of social security benefits plus any tax-exempt interest. If you have municipal bonds, that interest does come back into play to add up to or equal what’s called your provisional income.

If the provisional income is under $32,000 for a married couple, no benefits are subject to tax. However, that provisional income is between $32,000 and $44,000, up to 50% of the married couple’s benefits are subject to tax. If it’s over $44,000 for married, up to 85% of the benefits are subject to tax.

You can see the thresholds for singles are between $25,000 and $34,000. Anything over $34,000 is 85%. In the case of married filing separately and living with a spouse, 85% of social security is taxable regardless of your income level.

The important thing to remember here is that up to 85% of your social security benefits may be subject to tax depending on your other income. Again, it’s not a reduction, but this is a tax on social security.

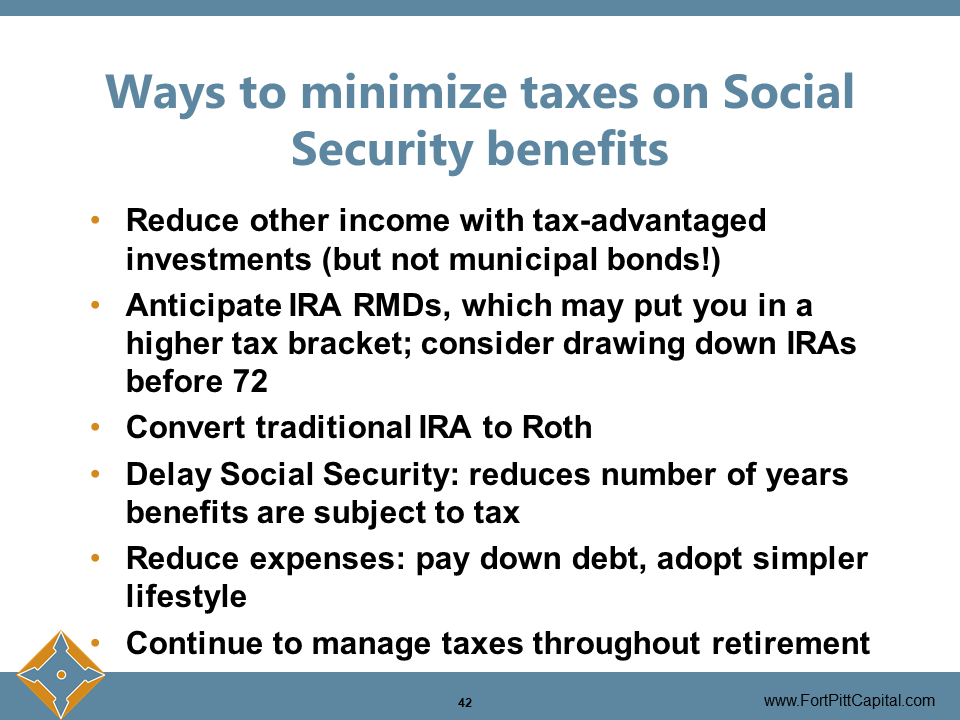

Ways to Minimize Taxes on Social Security Benefits

There are a couple of different things you can do to lower your income. Sometimes they’re easy to do, sometimes it’s a little harder to do depending on how much you have saved throughout your lifetime.

- You can do it by trying to limit your investment income depending on how you invest your taxable side. Again, you should be aware of those municipal bond interests. Which is usually tax-free, but it does count for income for purposes of calculating the tax on your social security benefit.

- You can anticipate your required minimum distributions from your IRA. A lot of times these are very high come age 72. You have to start drawing down, and depending on how much you have accumulated in those 401ks that have rolled into your IRAs, now you have to take out a required amount. A lot of times that amount will be over that $44,000 for married couples. You can consider drawing down on your IRAs a little bit earlier to try to reduce them.

- You can consider converting traditional IRAs to Roth IRAs, which will then generate tax-free income later.

- You can delay your social security which will reduce the number of years that benefits are subject to tax.

- You can reduce your expenses or pay down some debt to lower your income so that you have less chance of taxing. The numbers are very low so most individuals do have their social security taxed.

- Try to manage your taxes throughout retirement, not just through the first few years but throughout your retirement.

You should definitely consult your tax advisor to talk about your individual situation to see what you can do in order to reduce your income.

You Have Questions. We Can Help.

We would be glad to help you and we want to consider each of the questions that you come up with and help you come up with a plan for your personal situation.

Give us a call. Social security is too important for guesswork.

One of the problems I see frequently is people tend to take advice from others. They take advice from Aunt Sally or your neighbor Bob instead of the professionals. They hear, “oh, I claimed social security, you have to start taking, it’s not going to be there, well let us help you protect your nest egg and maximize your income and retirement.” It’s way too important for you not to talk about and look at the strategies. This is something that will affect not only you but your spouse.

Beth Lynch, CFP®

Senior Vice President

Fort Pitt Capital Group, LLC

680 Andersen Drive, Pittsburgh, PA 15220

(412) 921-1822 | blynch@fortpittcapital.com

Introduction

Introduction