How Life Insurance Can Build Wealth

Many people simply see life insurance as a way to protect their family financially should the worst happen to them. However, if chosen and used well, your life insurance policy can provide many more financial benefits during your lifetime and after. It’s a financial instrument commonly used by affluent families with the goal to increase and protect their wealth.

We’ve put together a summary of what you need to know to use your life insurance policy to build your wealth.

Can You Build Wealth With Any Life Insurance Policy?

Not all life insurance policies can be used as a vehicle to build wealth.

Life insurance policies can be defined as either a term life policy or a permanent life policy. With term life policies, you pay a monthly premium with the promise that should you die within the policy period, your family will receive a payout, known as a death benefit. Term policies have a set expiration date, and should your passing occur after this date, no death benefit will be paid.

Permanent life policies are similar in that a death benefit is paid out upon your death, but there’s no expiration date on the policy. This means that regardless of when you pass, the death benefit will be paid out. One other key difference with permanent life policies is that they provide a cash value. This cash value is often how millionaires build wealth using life insurance.

Types of permanent life policies include:

- Whole life: Lifetime coverage with fixed premiums, guaranteed death benefit, and guaranteed cash value growth

- Universal life: Flexible premiums and adjustable death benefit — cash value earns an insurer-declared interest rate and must be monitored to avoid lapse if underfunded

- Indexed universal life (IUL): Credited interest is linked to a market index, offering downside protection but limited upside — not invested directly in the market

- Variable universal life (VUL): Comes with investment subaccounts (stocks and bonds) and has the highest growth potential and risk — cash value and death benefit fluctuate with market performance

What Are the Benefits of Cash Value?

A cash value builds as you pay the premium of your permanent life policy. It’s made up of a portion of your premium payments, interest payments, and any dividends you receive through your policy. Over time, more of your premium payments will go toward your cash value rather than the insurance. Your cash value grows tax-deferred, meaning you won’t pay any tax on it while it’s in your cash value.

You can also access your cash value during your lifetime in various ways:

- Withdrawal: You can withdraw from your policy tax-free, provided you withdraw less than what has been paid into the policy — an important distinction because withdrawals above the cost basis are taxable. This will reduce the death benefit, often by more than you’ve withdrawn.

- Loans: You can take out a loan against your policy cash value, with no credit check or application required. You won’t pay income tax on your loan, and you can choose not to repay the loan, with the sum being deducted from your death benefit instead. Loans are typically tax-free if the policy stays in force until death. If it lapses or is surrendered with loans outstanding, the loan balance can become taxable.

- Collateral: If you’re taking out a personal loan, you can use your cash value to secure the loan and perhaps get more favorable terms.

- Surrender: If you cancel your policy, you can take the cash surrender value payment. The sooner you cancel your policy, the larger your surrender fees are likely to be.

- Premium payment: If you wish to stop paying premiums once you retire, you can use your cash value to pay toward your premiums.

All of these actions can potentially affect your policy, particularly the size of your death benefit. However, they all give you financial flexibility that allows you to spend and invest your money more freely.

How Can You Build Wealth With Life Insurance?

The cash value is a key instrument in building wealth, but it’s not the only aspect of a life insurance policy that can help you reach your financial goals. Here are various ways you can use a life insurance policy to build and protect your wealth.

To Leave Money to Family

Leaving money for your family after your passing is the main purpose of life insurance policies. Affluent families often use these funds to maintain their wealth.

Death benefits can be distributed without going through probate. They also won’t be subject to income tax, although they may be subject to estate or inheritance taxes. What’s more, if your estate is large enough that your beneficiaries will have to pay estate tax on it, the death benefit gives them a readily available liquid asset with which to pay.

For Investments

Wealthy individuals often use their cash value, whether by taking out a policy loan, using it as collateral or making a withdrawal, to fund other ventures. This prevents the need to liquidate assets, which may have less beneficial tax breaks or are building wealth themselves.

As Financial Security

Even wealthy people can experience periods where they’re short on funds, or when the market is down and their other assets have decreased in value. In some cases, access to the cash value lets them borrow without fees or penalties.

To Create Family Banks

It’s common for wealthy families to create an internal family bank through a permanent life policy. Using the cash value of this policy, family members can lend each other money at lower rates than a traditional bank can. This wealth preservation strategy was famously used by the Rockefeller family to secure and build their wealth.

To Reduce Tax Bills

Using a life insurance policy to grow your wealth while deferring tax on it is a commonly used strategy. Whatever growth your money experiences while it’s in the cash value is tax-deferred, allowing compound interest to grow your money as much as possible.

Common Life Insurance Mistakes That Affluent Families Can Make

Making the right financial decisions can be challenging, even for those who have spent years growing their fortune. That’s why affluent families often can make mistakes when using life insurance policies to build their wealth. Here are three of the most common ones that we see.

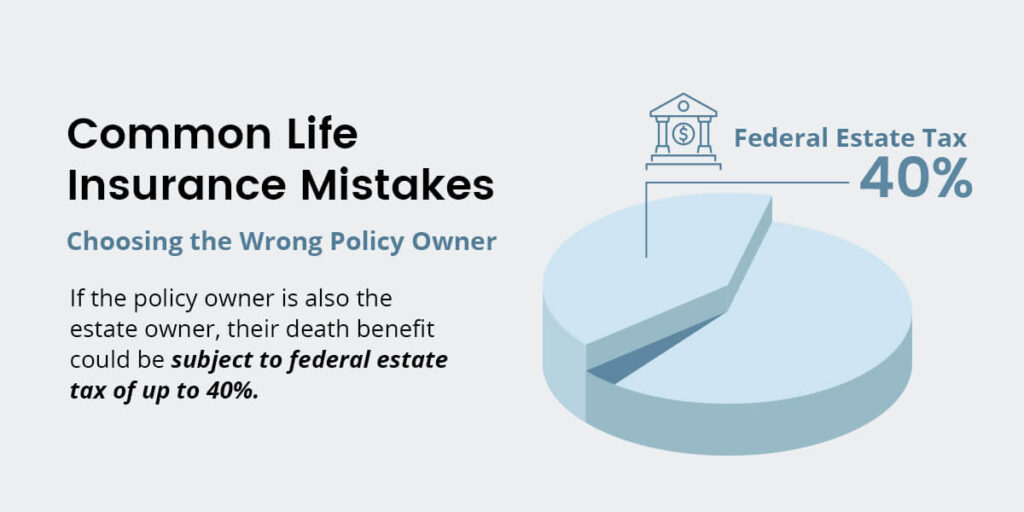

1. Choosing the Wrong Policy Owner

If the policy owner is also the estate owner, their death benefit could be subject to federal estate tax of up to 40%, not to mention state estate tax. It’s also important to note that if a personally owned policy is transferred to an irrevocable life insurance trust (ILIT) and the insured person dies within three years of the transfer, IRC §2035 typically pulls the proceeds back into the estate. This is known as the “three-year lookback” rule.

To avoid this, you could create an ILIT and make this the policyholder. This is a common strategy wealthy families use to avoid paying unnecessary estate taxes. The three-year lookback only applies when transferring an existing policy — not when the ILIT owns a new policy from inception.

2. Miscalculating How Much Your Beneficiaries Will Need

Often, families choose their policy based on their current financial situation, rather than what it’s likely to be at the time of the policy holder’s passing. They may fail to forecast how their wealth will grow and what their liabilities will be.

In general, you want to ensure that your death benefit will allow your family to continue to live their current lifestyle and leave them free of any debts. This means considering any mortgages, education and medical costs, business expenses, and any estate tax payments.

3. Not Reviewing the Policy

If you have a permanent life policy, this could last for decades. In that time, it’s highly likely that your financial situation will change, so it’s important that your policy is up to date and reflects your current financial situation and expectations. What’s more, changes to the market may lead to unexpected changes to your policy, and actions such as withdrawing from your cash value can affect the policy’s outcome.

To avoid this, review your policy annually and ensure that your cash value and projected death benefit are in line with what you expect. Additionally, affluent families often use max-funded policies (within MEC limits) to accelerate their cash value accumulation.

Build Your Wealth With the Right Life Insurance Policy

Finding the right life insurance policy for your family is challenging. You have to decide what type of policy is best for you, what size death benefit you’d like for your family, and more. Our financial advisors can help guide you on best life insurance policy that will serve your financial goals.

Our firm understands that finding a financial advisor you can trust is critical. Our insurance advisor services are here to help you find a policy based on your specific requirements, ensure it remains up to date, and even advise you on using life insurance to potentially build generational wealth.

For tailored guidance and professional advice on every financial aspect of life insurance policies, contact us today and get matched to your financial advisor.

Disclaimer: Kovitz Investment Group Partners, LLC D/B/A Fort Pitt Capital Group is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940 that provides investment management services to individual and institutional clients. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.

The information included herein may contain statements related to future events or developments that may constitute forward-looking statements. These statements may be in the form of financial projections and may be identified by words such as “expectation,” “anticipate”, “could”, “estimate”, “will”, “should” or similar terms. Such statements are based on the current expectations and certain assumptions of the author and are, therefore, subject to certain risks and uncertainties. Actual results may vary significantly based on individual circumstances, market conditions, and investment and insurance decisions.

The description of products, services, and performance results of Fort Pitt Capital Group contained herein is not an offering or a solicitation of any kind. Past performance is not an indication of future results. Securities investments are subject to risk and may lose value.